American Clean Power

Green Hydrogen

Hydrogen made with clean power is the most promising solution for decarbonizing heavy industrial manufacturing and chemical processes that are essential to the U.S. economy.

Green hydrogen is a fuel produced by splitting water into hydrogen and oxygen using renewable electricity. To establish a domestic green hydrogen economy and unlock the climate and job creation potential of this nascent clean energy source, it is necessary to make green hydrogen cost-competitive with more carbon-intensive forms of hydrogen production.

ACP developed a Framework to address these challenges. Read more.

ACP’s Proposal

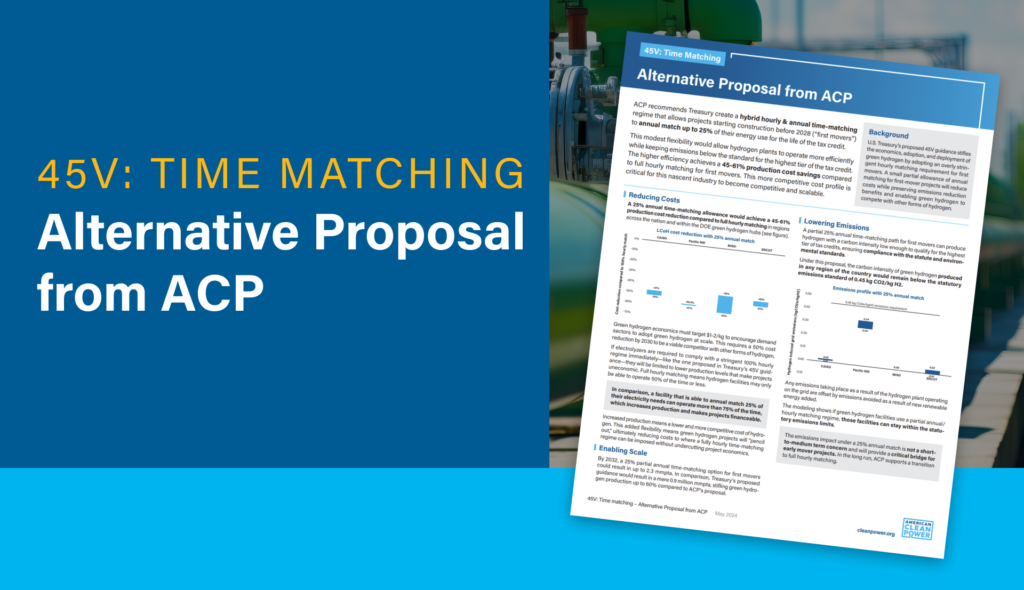

As the Administration considers updated guidance for the Green Hydrogen 45V tax credit, ACP recommends Treasury create a hybrid hourly & annual time-matching regime that allows projects starting construction before 2028 (“first movers”) to annual match up to 25% of their energy use for the life of the tax credit.

This modest flexibility would allow hydrogen plants to operate more efficiently while keeping emissions below the standard for the highest tier of the tax credit. The higher efficiency achieves a 45-61% production cost savings compared to full hourly matching for first movers. This more competitive cost profile is critical for this nascent industry to become competitive and scalable.

Download ACP’s fact sheet to learn how this proposal would minimize emissions while allowing the nascent industry to scale.

New Study Finds Treasury’s Proposal Would Stifle Adoption of Green Hydrogen

New analysis from Wood Mackenzie commissioned by ACP shows the Administration’s guidelines requiring hourly matching starting in 2028 will stifle green hydrogen deployment by making it too expensive.

Hanging in the balance is the nascent U.S. green hydrogen industry, which is essential to addressing the climate crisis and represents the most promising solution for decarbonizing heavy industrial manufacturing and chemical processes that are essential to the U.S. economy.

As the data shows, the current Treasury proposal will not achieve the economic or environmental goals of building out a green hydrogen industry articulated by Congress in the passage of the Section 45V tax credit.

But there’s a solution: a longer glide path for the implementation of the hourly time-matching requirement and flexibility for first-mover projects, which come online before that transition, to be exempted from the more granular time-matching requirements for the life of the tax credit.

Wood Mackenzie’s analysis finds that ACP’s proposal, issued in June 2023, leads to significantly more green hydrogen deployment by 2032 and puts the industry closer to the pathway required to achieve a net-zero emissions economy.

What to Know About ACP's Green Hydrogen Framework

Answer your questions about ACP’s Green Hydrogen Framework in our FAQ.

Green Hydrogen

What is green hydrogen, and what role does it play in the broader clean energy economy?

Hydrogen is the most abundant molecule in the universe. It also burns cleanly. Already used widely in industrial chemicals, refining, and ammonia production, hydrogen is often recognized as a critical tool in deep decarbonization, especially for hard-to-abate sectors (e.g., long haul transport, agriculture, manufacturing) that currently account for 36% of total U.S. emissions.

“Green hydrogen” is simply hydrogen produced with little to no greenhouse gas emissions. Through a process called electrolysis, electricity from renewable and other clean energy sources is used to extract hydrogen from water. Hydrogen is considered green if it is produced with lifecycle greenhouse gas emissions intensity of less than 0.45 kilograms of carbon equivalent per kilogram of hydrogen.

In contrast, gray hydrogen is produced using natural gas via methane reforming or coal via gasification. Natural gas reforming, responsible for the majority of hydrogen production today, generates ~9 kilograms of CO2 per kilogram of hydrogen production.

Why is ACP engaged on this issue?

ACP members are among the leading companies advancing the green hydrogen industry. Our members are engaged and innovating along the entire value chain, including:

- Manufacturing electrolyzers necessary to produce hydrogen;

- Building and operating green hydrogen facilities; and

- Generating the clean energy needed to produce green hydrogen.

ACP members have a strong interest in this industry and seek a regulatory framework that supports the establishment of a thriving green hydrogen economy while driving towards the country’s climate goals.

Is green hydrogen cost-competitive?

Green hydrogen can be cost-competitive when accounting for the $3/kg production tax credit included in the Inflation Reduction Act.

By comparison, gray hydrogen costs range from >$1 to $1.50 per kilogram depending on the cost of natural gas, while blue hydrogen (hydrogen produced from fossil fuels with carbon capture and sequestration) cost is estimated between $2.0-$2.5/kg. Blue hydrogen can qualify for a tax credit of up to $1/kg, bringing the cost range to $1.0-$1.5/kg. This is the cost point that green hydrogen must match or surpass.

Today, Bloomberg New Energy Finance estimates the levelized cost of green hydrogen (LCOH) at over $4 per kilogram—well above the cost of gray hydrogen. The Inflation Reduction Act helps bridge this gap with a $3/kg production tax credit for the first ten years of production. The tax credit is critical to kickstart the green hydrogen industry and making sure companies can qualify cost-effectively is crucial.

Will this compromise proposal enable green hydrogen to compete effectively with gray or blue hydrogen?

ACP’s compromise framework positions “first-mover” green hydrogen to be cost-effective in the early years of deployment.

At today’s capital cost for a new electrolyzer, industry participants are confident that an initial annual time matching structure will allow them to achieve green hydrogen production at costs competitive with today’s gray hydrogen market.

As the industry matures, achieving economies of scale and a robust supply chain, capital costs are expected to fall. This will enable a transition to a stricter clean energy accounting structure—i.e., hourly matching.

Will this proposal lead to additional clean energy additions to the grid?

Under ACP’s compromise position, green hydrogen facilities will need to procure clean energy from new or repowered clean power plants, thereby increasing demand for wind, solar, and battery storage. Allowing excessively congested clean power plants to also serve green hydrogen facilities helps these plants to continue to operate and means America gets the most out of its existing clean power resources.

The Department of Energy has laid out a clean hydrogen strategy and roadmap which envisions 10 million metric tons of clean hydrogen production by 2030. If the country achieves just 25% of this goal, it will lead to an estimated 15-20 GW of new clean power capacity. And this capacity is expected to be above and beyond what will be demanded by utilities and C&I customers—in other words, it will be built strictly due to demand from hydrogen producers.

Could an annual matching structure increase near-term electric sector emissions, defeating the purpose of green hydrogen?

There have been numerous studies attempting to project the emissions impact of different time-matching regimes in different parts of the country. The results are mixed. Some scenarios indicate the potential for near-term emissions increases with annual matching and others do not. Against this uncertainty, ACP is proposing guardrails to require a timely transition to stringent time-matching. ACP’s approach establishes a phase-in period that allows the first wave of projects (starting construction before 2029) to get off the ground under an annual matching regulatory regime, helping to establish the industry.

The net effect is the establishment of a competitive green hydrogen industry in the first few years that will help achieve deep decarbonization for decades.

Why is some flexibility required for first mover facilities?

The long-term benefits of green hydrogen cannot be achieved if the industry never gets off the ground. An overly stringent regulatory regime at the outset will work counter to the purpose of the green hydrogen incentives and undermine to our long-term emissions reduction goals.

Currently, green hydrogen is scarce and expensive, especially in comparison to conventional hydrogen—gray and blue—due in large part to the high capital costs inherent with a new market or technology. Requiring strict hourly accounting rules out of the gate will further increase these costs, making it difficult for green hydrogen to compete. Hourly matching requires procuring clean electricity at all hours of operation or operating electrolyzers at low-capacity factors. Green hydrogen projects would thus be forced to significantly over-procure renewables and/or storage to ensure production equipment will not be idled during periods of low resource availability. To provide needed short-term certainty for early green hydrogen movers, hydrogen facilities should be able to begin under an annual time-matching regime with a phase in of hourly time-matching toward the end of the decade when costs decline. This will allow early-mover green hydrogen facilities to get off the ground and help decrease emissions over the long term.

How much green hydrogen production will come online?

Estimates vary widely, which is to be expected for a nascent industry. The Department of Energy’s U.S. National Clean Hydrogen Strategy and Roadmap cites an opportunity of 10 million metric tons (MMT) of clean hydrogen production by 2030 and 50 MMT by 2050. If green hydrogen captures half of this market, it implies 30-35 GW of electrolyzer capacity by 2030. Bloomberg New Energy Finance forecasts a similar amount of electrolyzer capacity at 30 GW by 2030. DNV, an international standards and accreditation firm, anticipates under 10 GW of electrolyzer capacity in the U.S. at the end of the decade. McKinsey & Company is tracking just 200 MMT of committed green hydrogen production, plus another 1.1 MMT in the planning stage. McKinsey’s tracking implies ~10 GW of electrolyzer capacity by 2030.

Achieving even the most modest of these estimates will be a major accomplishment for the clean hydrogen industry. For perspective, if green hydrogen follows the growth curve of the solar industry from 2006-2015 (94% annual growth), there will be ~5 GW of electrolyzers in 2030. Surpassing 20 GW by 2030 will require a 150% annual growth rate.

While the outlook remains uncertain, there is consensus that green hydrogen must become cost competitive to grow.

Will this proposal create jobs and support economic growth?

Jobs and economic growth will stem from two sources as the green hydrogen sector grows. First, green hydrogen projects will create jobs as companies seek to develop, construct, and operate new facilities. Companies supporting electrolyzer supply chains will also create jobs as they manufacture parts and components for the industry.

Second, the clean power industry will see job creation and economic growth thanks to new demand for clean energy from these green hydrogen facilities. This means more electricians, wind turbine technicians, marine vessel operators, solar installers, and battery storage engineers—just to name a few.

Considering only the clean power economic impacts, ACP estimates green hydrogen demand for clean power will create 21,000 jobs by 2030 and drive more than $20 billion in economic output.

How is Europe approaching green hydrogen regulation?

The European Union (EU) aims to produce 10 million tons and import another 10 million tons of green hydrogen by 2030. That will entail nearly 14% of the EU’s total electricity in 2030. The EU recently proposed regulations for what qualifies as green hydrogen under its clean energy transition plan to meet the bloc’s renewable energy targets. These proposed rules are likely to influence the U.S. Treasury Department’s guidance d for green hydrogen under the Inflation Reduction Act.

The EU’s rules aim to harness the demand from green hydrogen to spur a new wave of investment in clean energy—rather than suck up large chunks of the bloc’s existing clean energy capacity. The rules also aim to carefully balance the need to ensure that green hydrogen is largely powered by electrons from clean energy projects while allowing the green hydrogen industry the flexibility to grow.

The proposed rules are as follows:

- For green hydrogen producers that start operations after 2028, they must procure power through supply contracts from relatively new clean energy projects—no older than three years.

- Green hydrogen producers must secure clean energy from projects located in the same or interconnected region of Europe’s electricity market.

- Up to 2030, green hydrogen producers will have to show that the total quantity of green hydrogen produced and clean electricity consumed are aligned over a period of 30 days (monthly time matching). From 2030, green hydrogen producers will have to show that the green hydrogen production occurs in the same hour (hourly time matching) that the clean energy was generated.

- Green hydrogen producers can gain the green designation if they operate in an area of the EU grid where more than 90% of the power is clean energy without ensuring they are purchasing clean energy.

- Green hydrogen producers can also gain the green designation if they show that hydrogen production occurs when power prices are so low that fossil-fuel generators can’t operate profitably or carbon intensity levels are very low. The proposed rules don’t allow green hydrogen producers to qualify if they are powered by nuclear power plants.

- These proposed requirements are intended to apply to both producers within the EU, as well as producers outside the EU, who wish to export green hydrogen to the EU.