NEW REPORT: Offshore Wind Momentum Grows with Sector to Invest $65 Billion and Create 56,000 U.S. Jobs by 2030

Jul 9 2024

12 Gigawatts (GW) under contract including 4 GW under construction

WASHINGTON D.C., July 9, 2024 – The American Clean Power Association (ACP) today released the 2024 Offshore Wind Market Report, showing the clean power industry is projected to invest $65 billion in offshore wind projects by 2030, which will support 56,000 jobs in the United States. There are currently 12 gigawatts (GW) of projects with active offtake agreements, including 4 GW under active construction at Vineyard Wind, Revolution Wind, and Coastal Virginia Offshore Wind.

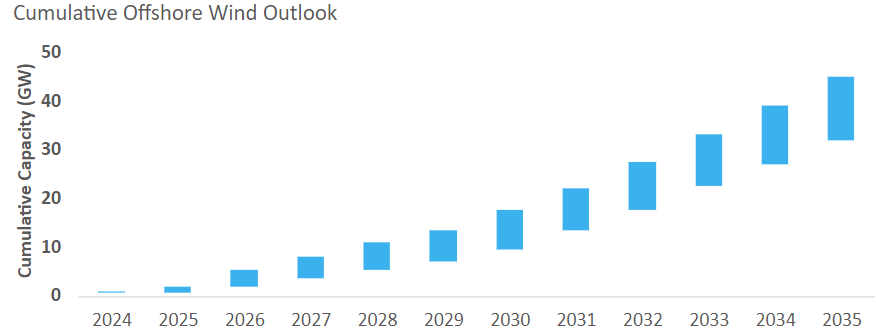

Across 37 leases in the U.S., there are now 56 GW (56,363 MW) of capacity under development, enough electricity to power the equivalent of 22 million homes.Market analysts forecast that there will be 14 GW of offshore wind deployed by 2030, 30 GW by 2033, and 40 GW online by 2035. These outlooks build on the 7.6 GW of offshore wind projects seeking to be operational by the end of 2027.

“After the successful start-up of the 132 MW South Fork wind farm earlier this year, and with 136 MW operational at Vineyard Wind, offshore wind is gaining momentum with three projects under construction and thirty-seven more in development,” said ACP Chief Policy Officer Frank Macchiarola. “Harnessing America’s offshore wind resources will boost economic activity, create jobs, reduce pollution providing environmental and public health benefits, and strengthen America’s energy security by enhancing grid reliability and energy independence.”

The new report also highlights the economic impact of offshore wind on domestic U.S. shipbuilding, port infrastructure, and other supply chain activities. There are more than 40 new vessels currently on order or under construction to support the industry. Investments include 28 Crew Transfer Vessels (CTV), seven Service Operation Vessels (SOV), two different types of installation vessels, and two tugs and two barges to support offshore wind operations and maintenance. The industry committed a record $3 billion of supply chain investment in 2023 alone, with total infrastructure investment announcements now exceeding $9 billion.

The Offshore Wind Market Report underscores the important role that states are playing in driving U.S. offshore wind development. State solicitations could award procurement contracts for an additional 8,800 – 12,200 MW of offshore wind projects in the second half of 2024, all located off the Northeast coast. States with ongoing or upcoming solicitations include New Jersey, New York, Massachusetts, Rhode Island, and Connecticut.

New Jersey took the lead among the states for most offshore wind capacity under contract. The Garden State has 5,252 MW of projects under contract. Virginia has the most offshore wind capacity under construction, with 2,587 MW.

The report notes that while contract cancellations and rebidding impacted offshore wind development in 2023, states have been quick to open new solicitations and streamline processes.

The momentum and investment are likely to continue with the Bureau of Ocean Energy Management (BOEM) planning to hold four lease sales in the second half of 2024 in the Central Atlantic, Oregon, the Gulf of Maine, and a second Gulf of Mexico lease sale. These four lease sales will open nearly 1.9 million acres of federal waters to offshore wind development, potentially paving the way to more than 20 GW of future clean power generation capacity.

BOEM has issued a Record of Decision (ROD) for nine lease areas, involving 12 projects, as of July 5, 2024, up from two at mid-year 2023, allowing these projects to move forward with construction. Seven other projects have submitted Construction and Operations Plans (COPs), this includes five projects which have received a draft Environmental Impact Statement (EIS) allowing them to move further along with the rigorous permitting process.

The full 2024 Offshore Wind Market Report is accessible here.