REPORT: US Q1 Wind Installations Increase 91% YOY, but Uncertain Regulatory Environment Stalls Turbine Orders

Jul 28 2025

• H1 year-over-year turbine orders fall 50%

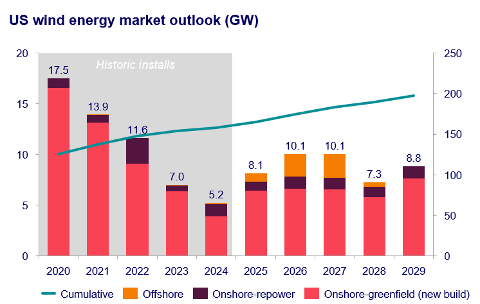

• Industry will see average installations of roughly 9 GW per year over next 5 years, amid regulatory uncertainties and market challenges

Source: Wood Mackenzie

HOUSTON/WASHINGTON, July 28, 2025 — The Q1 U.S. wind market exceeded 2024’s pace, more than doubling activity with 2.1 gigawatts (GW) of installations—but regulatory uncertainty led to a significant pullback in wind turbine orders, according to the U.S. Wind Energy Monitor report released today by Wood Mackenzie and the American Clean Power Association (ACP).

The report shows that all installations in Q1 came from new build onshore activity. Wood Mackenzie projects that a total of 8.1 GW of installed capacity will come online this year, including onshore, offshore, and repowers.

However, tariffs and policy uncertainty have placed significant challenges on the market, driving a 50% decrease in H1 turbine orders compared to the same period last year, taking them to their lowest level since 2020.

“The surge in first quarter wind installations, combined with a strong development pipeline, underscores the wind industry’s resilience and its capacity to rapidly deliver the clean, affordable, and reliable energy America needs. But this momentum is threatened by the changing policy landscape. Regulatory obstructions will drive up costs, putting at risk the nation’s ability to meet its energy demands with homegrown clean power,” said John Hensley, ACP Senior Vice President of Markets and Policy Analysis.

(Note: forecasts in this report were developed after the passage of the One Big Beautiful Bill Act, but do not incorporate potential effects resulting from the Department of Interior’s July 15 directive requiring the Secretary to review wind and solar projects.)

Onshore activity

Turbine orders have slowed in 2025, but demand—especially for safe harbor orders—is projected to rebound in the second half following the One Big Beautiful Bill Act’s (OBBBA) final passage.

“Market volatility will prompt a short-term decrease in onshore additions,” said Leila Garcia da Fonseca, director of research at Wood Mackenzie. “A quarter-over-quarter net reduction of roughly 430 MW in the U.S. onshore wind outlook from 2025-2029 reflects growing uncertainty for currently under-development projects, mainly driven by ongoing permitting challenges, tariff risk, and now a sunset of tax credits.” A late-cycle spike is anticipated in 2029–2030 with developers looking to capitalize ahead of the tax credit expiration.

Western states, which will add 9.4 GW of installations through 2029, will see more activity than other regions.

Offshore activity

As almost all offshore projects in Wood Mackenzie’s five-year outlook are already under construction, the outlook remains largely unchanged. Wood Mackenzie is projecting a total of 5.9 GW of offshore wind capacity to come online by 2029.

“While we assume projects currently under construction or heading to construction will come online, we don’t expect to see any additional projects take a final investment decision during President Trump’s second term in office,” said Garcia da Fonseca. “This could have a significant impact on the number of offshore projects constructed in the 2030s.”

OBBBA to spur safe harbor activity ahead of pending IRS guidance

Despite near-term volatility, Wood Mackenzie forecasts average annual installations of 8.9 GW over the next 5 years across onshore, offshore, and repowering segments. By the end of 2029, approximately 44 GW of wind power capacity is expected to be installed, comprising nearly 33 GW from new onshore greenfield projects, 6 GW from offshore development and 5.4 GW from repowering. Cumulative capacity should reach 197 GW.

Following the passage of the OBBBA on July 4, 2025, and a subsequent executive order on July 7 challenging IRS guidance on start of construction definition, the wind industry faces regulatory uncertainty as the Treasury prepares revised rules.

The final version of the OBBBA shifts tax credit eligibility from “placed in service” to “start of construction,” creating a 12-month window for developers to begin projects and qualify for the four-year safe harbor, pending IRS confirmation.

This change is expected to drive increased safe harbor equipment activity for projects targeting 2029–2030 CODs, as permitting delays and supply chain constraints continue to limit earlier timelines.

“Wood Mackenzie’s modelling shows tax credit expiration would increase unsubsidized Levelized Cost of Energy (LCOE) by 25% on average, a more substantial impact than tariff scenarios, which can add up to 10% to LCOE,” said Garcia da Fonseca. “This underscores the critical role of policy support for continued wind deployment.”

Purchase the full report from Wood Mackenzie, and discover more in the complimentary Executive Summary.