Data Highlights from ACP’s Annual Market Report

2022 Marked Third-Highest Year for U.S. Utility-Scale Solar, Wind, and Storage Installations

But Growth Fell Short of Expectations

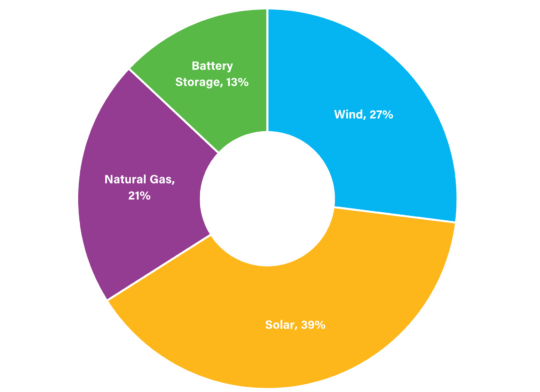

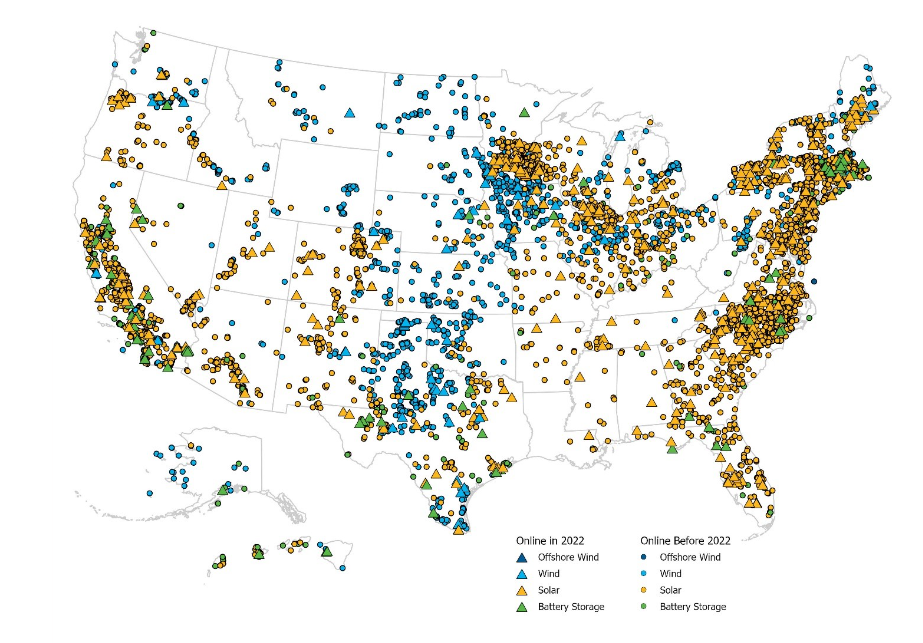

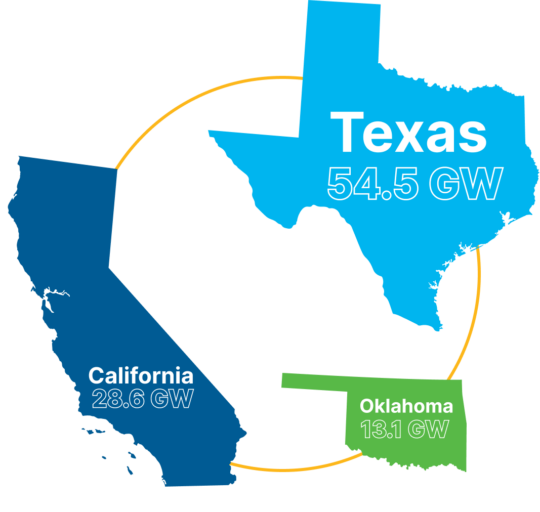

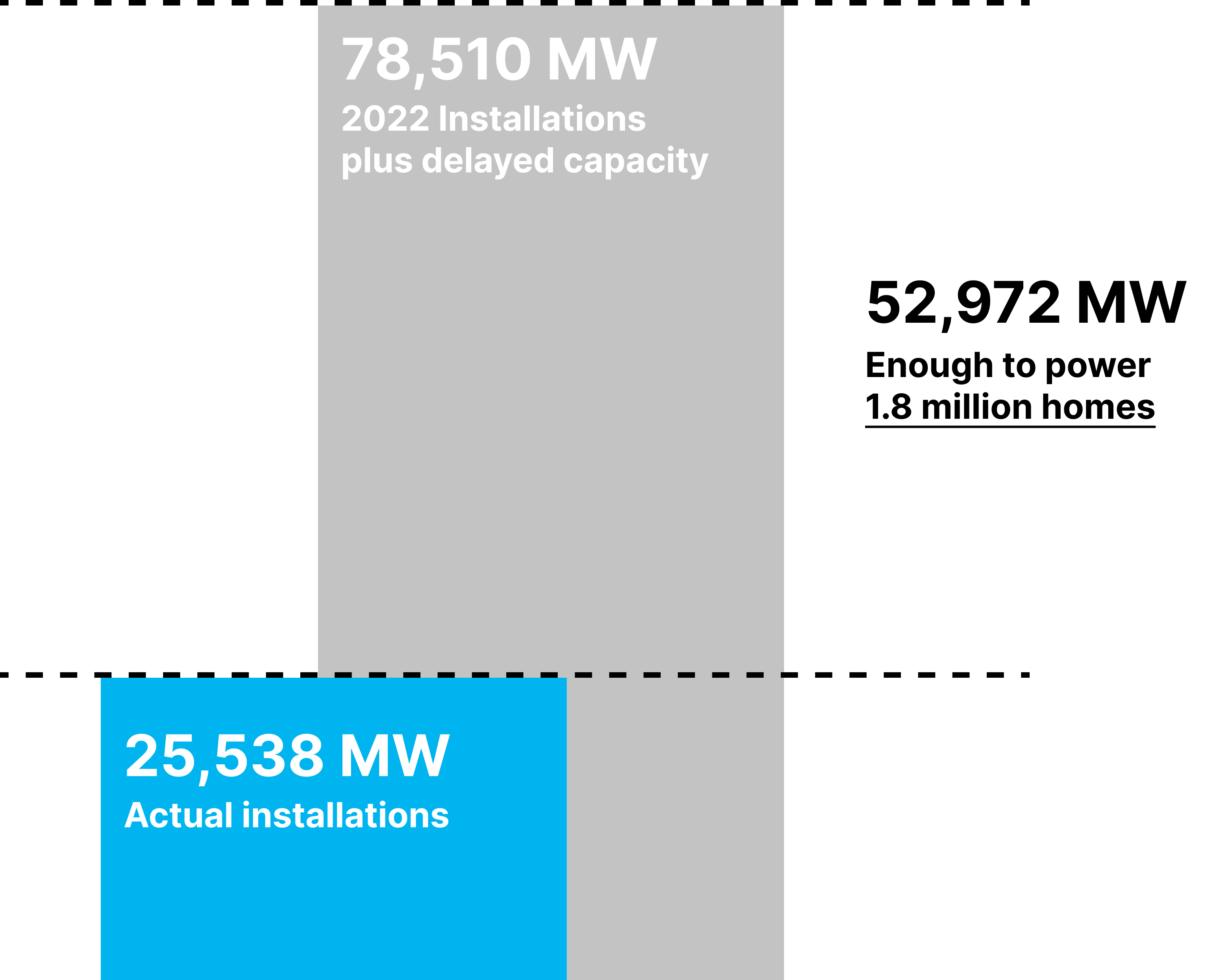

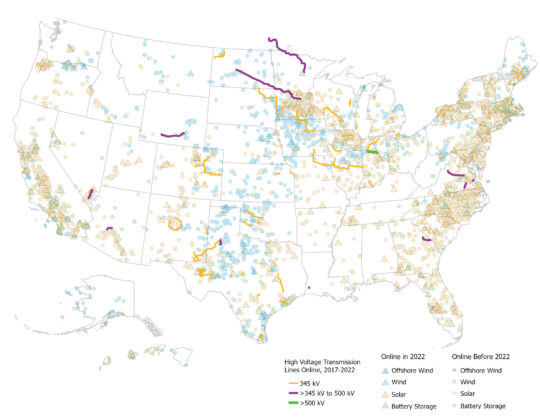

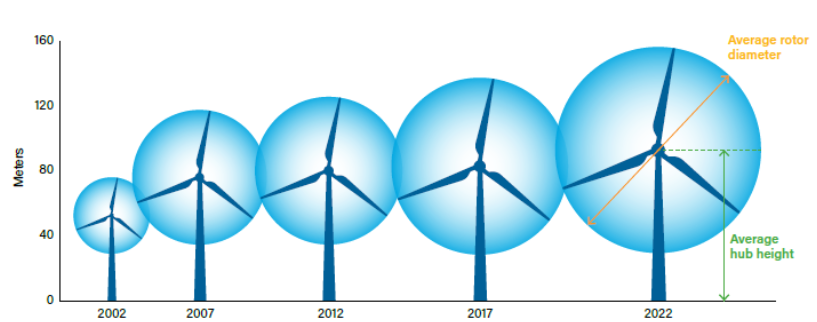

The clean energy revolution is underway. 2022 was the third-largest year for clean energy deployment on record, with 25.5 gigawatts (GW) installed. As these projects came online, Congress made unprecedented investments to modernize our energy systems, bringing the potential to more than triple the annual installations of wind, solar, and energy storage facilities by the end of the decade.

However, a decline in deployment volume from the previous two years underscored the continued headwinds facing the industry. Supply chain constraints, lengthy delays connecting projects to the grid, unclear trade restrictions, longstanding permitting obstacles, and uncertainty over IRA implementation hindered project development and investment activity.

To better understand the accomplishments and challenges of the clean power industry in 2022, interact with the topline data from ACP’s new Clean Power Annual Market Report below. For in-depth analysis of the total U.S. clean energy market, download the full 180-page members-only report.