Welcome to the Clean Power Annual Market Report 2021

In 2021, the U.S. clean power industry hit significant milestones, but current growth must accelerate to reach net zero grid by 2035.

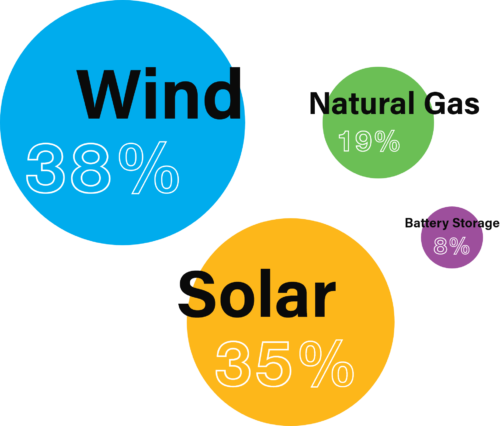

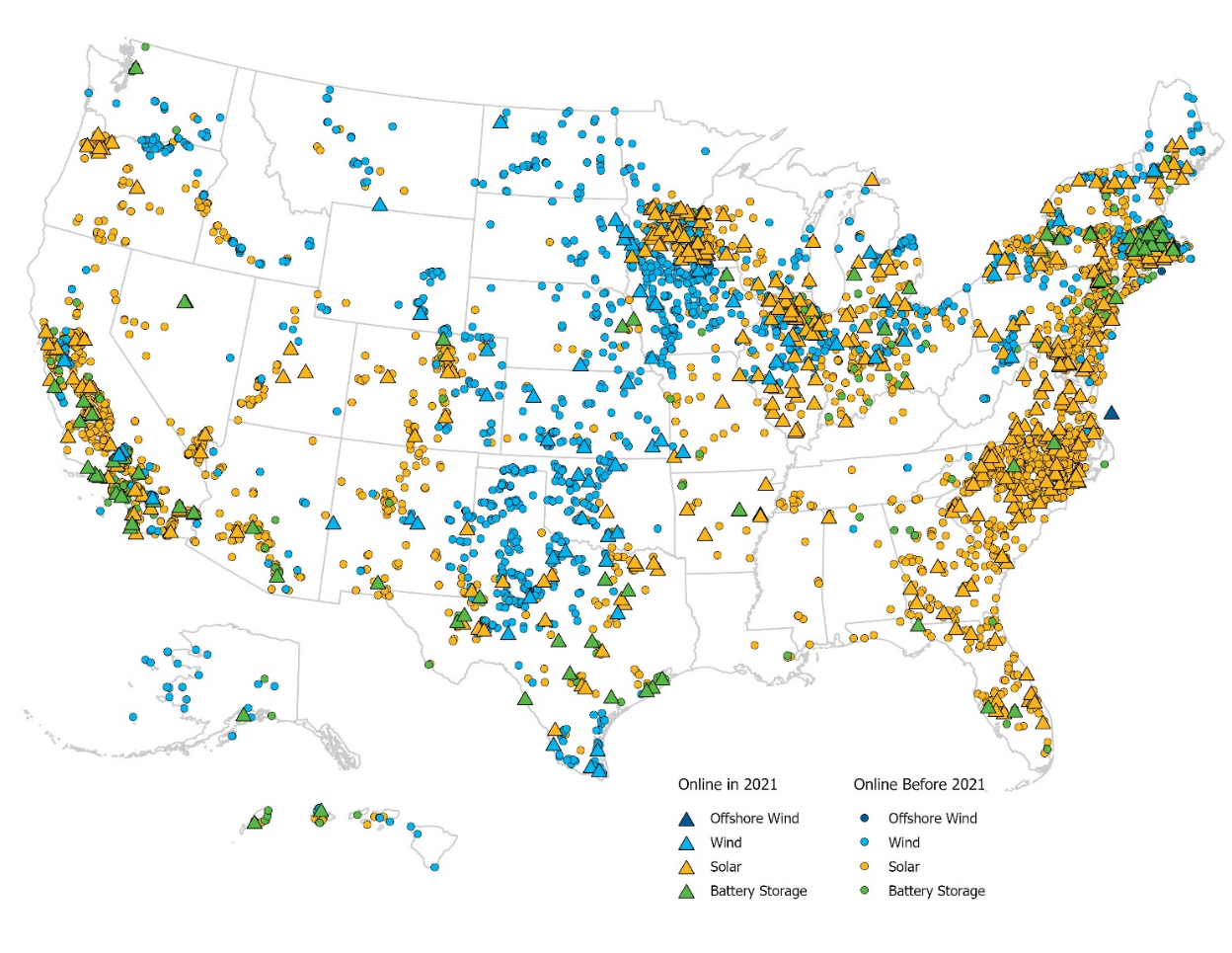

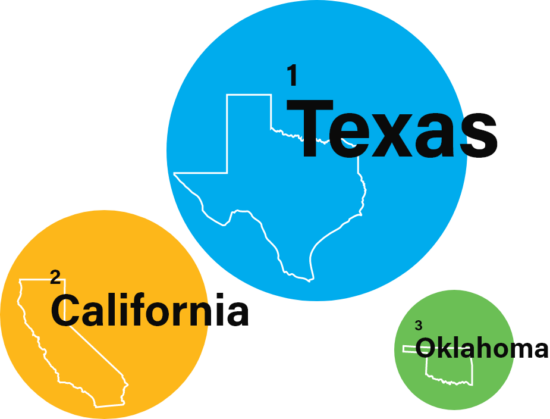

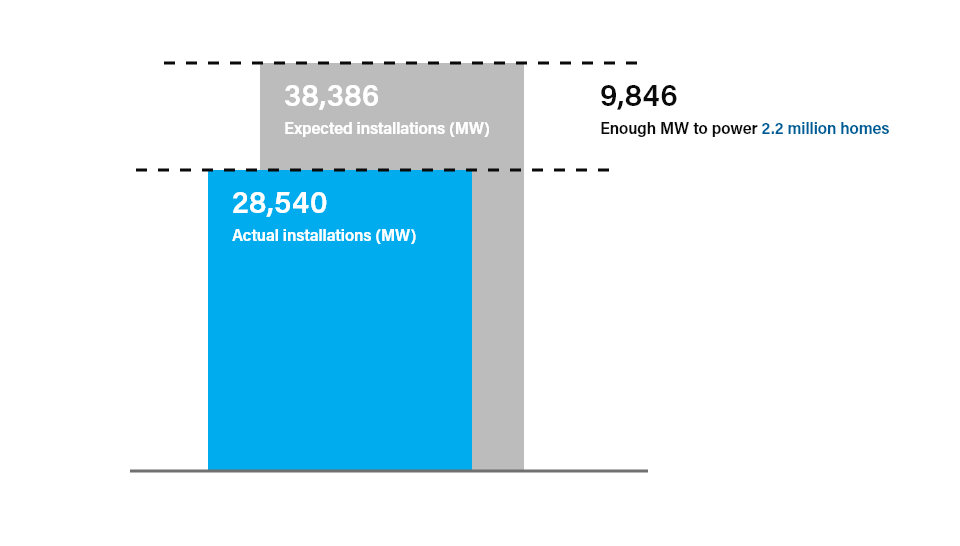

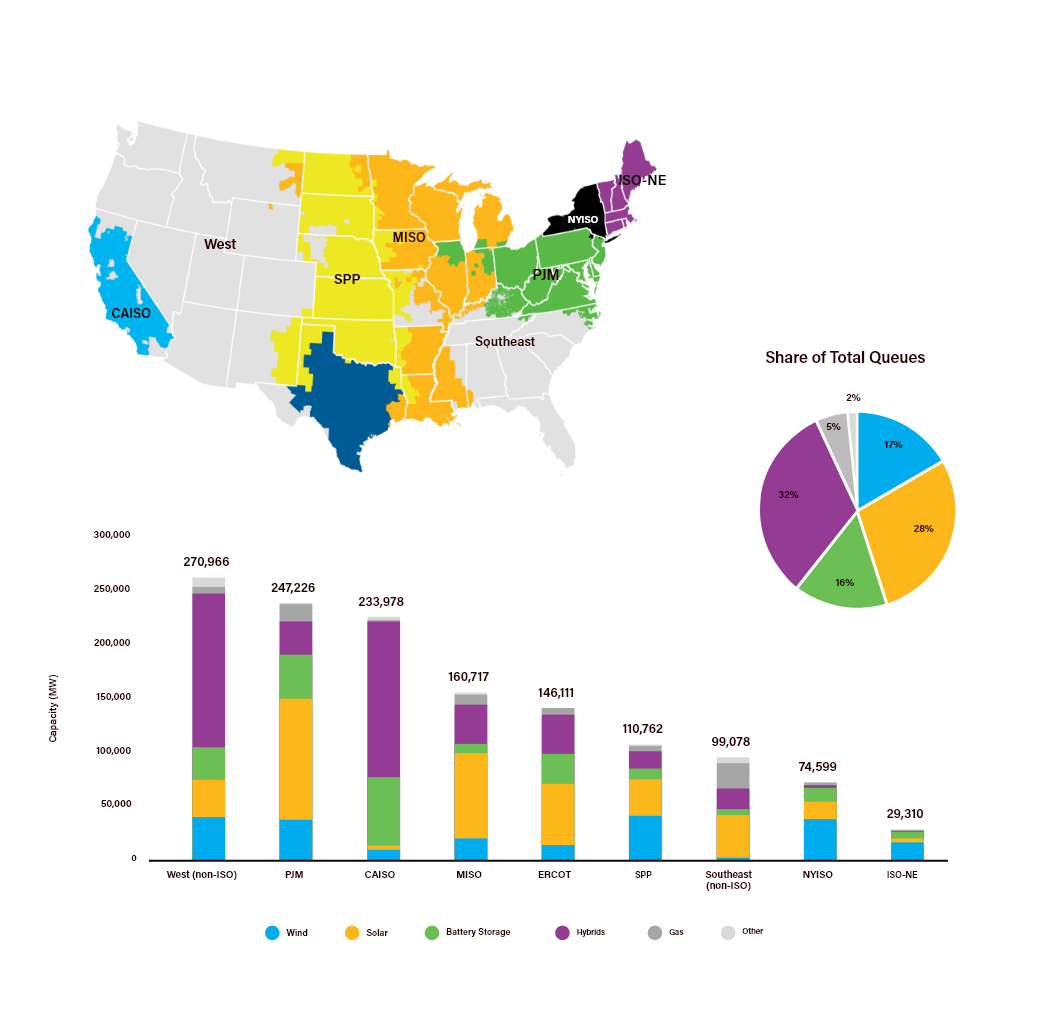

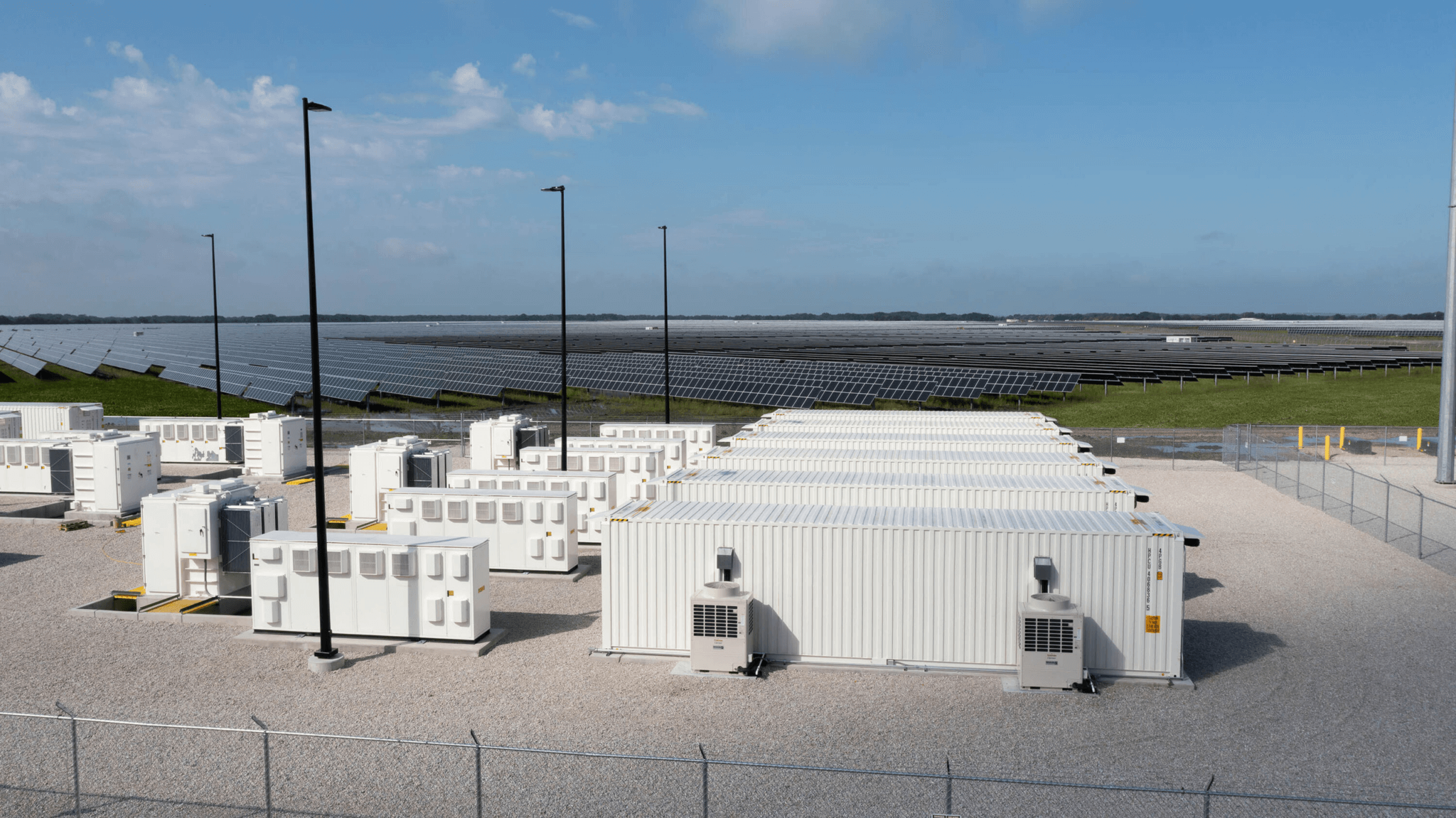

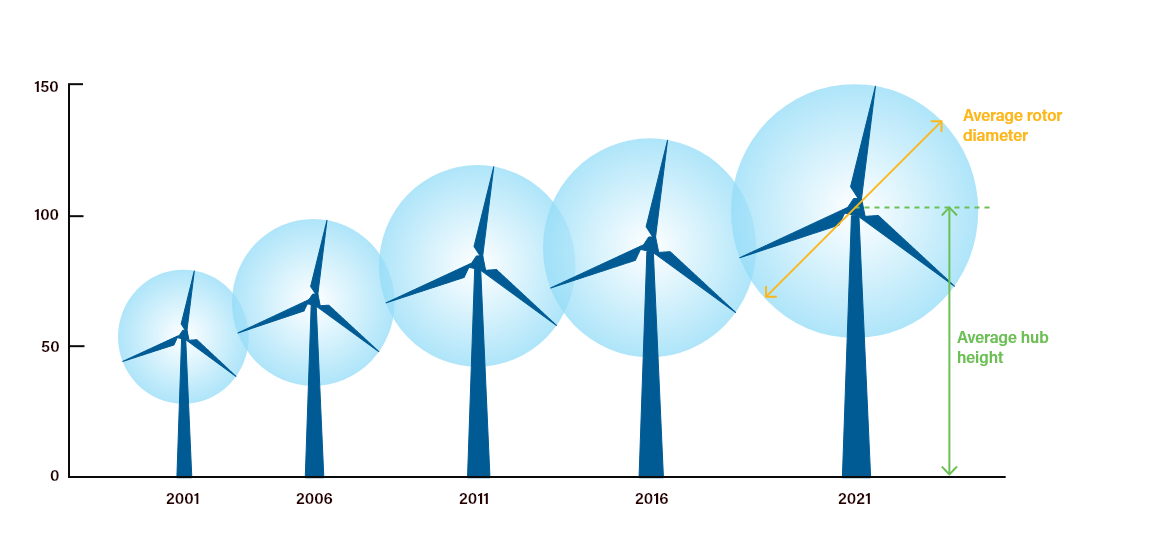

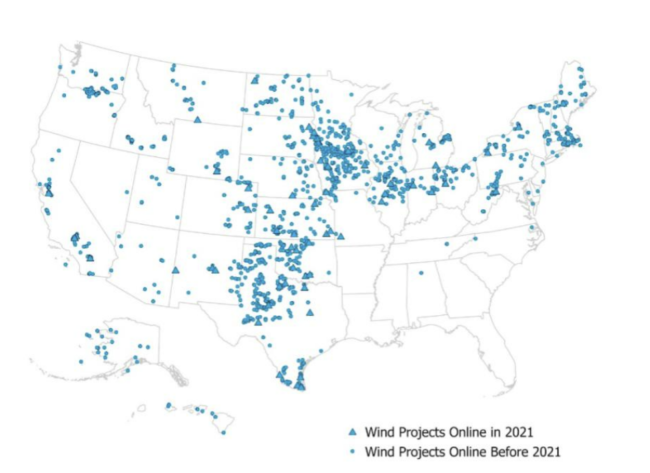

2021 marked a record year for clean power. Our industry reached a major milestone by surpassing 200 GW of renewable energy capacity. But despite this laudable progress, 2021’s pace of clean energy deployment must accelerate at a more rapid rate to meet America’s climate and emissions goals. While 2021 installations of solar and storage soared and costs remained low, bottlenecks in transmission and policy uncertainty threaten to stall future development. Understand the progress and challenges of American clean energy in 2021 by interacting below with data collected for ACP’s new Clean Power Annual Market Report 2021.