A guide to buying wind power for Fortune 500 companies

Fortune 500 companies asetting ambitious targets for renewable energy procurement, and they choose wind more than any other source.

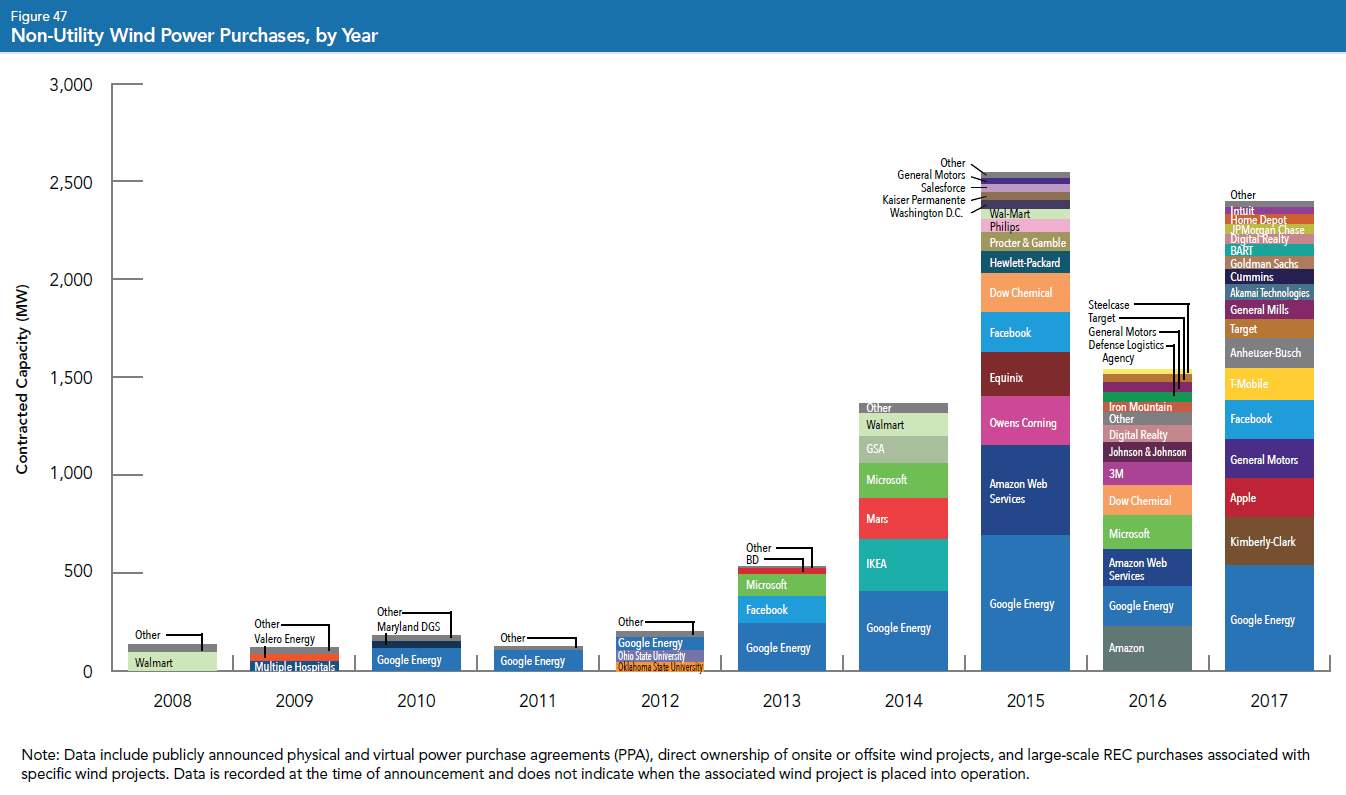

Fortune 500 companies and others are setting ambitious targets for renewable energy procurement, and they choose wind power more than any other source. How much wind power are they buying? More than 9,100 megawatts (MW) were purchased through the end of 2017 by corporate and other non-utility customers. That’s more than Oklahoma’s entire installed capacity, the second largest wind state in the country.

And now AWEA has a guide to help new corporate buyers power their operations with wind.

Corporate buyers represent 94% of total non-utility wind deals, which demonstrates significant leadership among other customers like cities and universities. The trend has continued in so far in 2018, with recent customers including Adobe Systems, AT&T, Brown Forman, Kohler, and Nestlé.

Wind energy clearly provides a cost-competitive solution for companies seeking to power their businesses with clean, renewable energy at a long-term stable price.

But they aren’t done yet. There is a big world of corporate customers that have set renewable energy targets but still need to sign on the dotted line to make the promise a reality.

For those companies, AWEA’s newest primer, the “Corporate Buyers Guide to Wind Energy,” introduces new corporate customers to the world of wind energy procurement. The educational primer begins by explaining the many ways that a buyer can purchase wind energy from specific wind projects.

For example, customers can procure wind power through a wholesale energy transaction by signing a physical or virtual power purchase agreement (PPA). These are long-term contracts to purchase energy, and potentially capacity or other environmental attributes.

For example, customers can procure wind power through a wholesale energy transaction by signing a physical or virtual power purchase agreement (PPA). These are long-term contracts to purchase energy, and potentially capacity or other environmental attributes.

Wind PPAs remain one of the most popular tools available for corporate customers, with more than 8,000 MW in PPAs signed since the beginning of 2008.

Companies can also buy wind power through a retail energy transaction with their local utility or another type of retail electricity provider. Retail transactions include green tariffs, like the one General Motors and Switch signed up for this year, and other methods.

Direct investment can happen through wind project ownership, as well as through tax equity and debt investment. Corporate customers can also buy renewable energy credits (RECs) from a specific wind project, preferably through a long-term contract. These deals are most helpful when the customer buys RECs above market price, or when the wind project is located in a high-demand REC market.

For those interested in learning more about PPAs, the primer provides a deep dive on both virtual and physical PPAs. It defines common terms found in a PPA like “point of delivery,” “availability guarantee,” and “termination rights.” The primer also shows the typical negotiation points that can be expected with a PPA, and the ways in which buyers and sellers can allocate risks inherent to the negotiation points.

AWEA will continue releasing primers in the future with deep dives on other procurement methods. We’ll also continue to provide authoritative U.S. wind industry data and analysis through products like WindIQ and our annual and quarterly market reports.

With the cost of wind falling by 67% over the past eight years, the time is now for corporate buyers to lock in historically low wind prices. Read and share the “Corporate Buyers Guide to Wind Energy” today!