Wall Street data: successful PTC cuts wind’s costs, job not done

New data from Wall Street investment firm Lazard, Inc. show that the renewable energy Production Tax Credit (PTC) has been instrumental in successfully reducing the cost of wind energy.

Lazard notes the PTC has enabled private sector investments in manufacturing and R&D that have reduced the cost of wind energy by more than 60 percent over the last six years. They explain, “alternative energy costs have decreased dramatically in the past six years, driven in significant part by federal subsidies and related financing tools, and the resulting economies of scale in manufacturing and installation.”

Lazard’s data support the conclusions of AWEA’s recently released white paper, “Wind Energy and the PTC: Sustaining an American Success Story.” That paper explains how the policy stability provided by the PTC has enabled the wind industry and its large network of component suppliers to make long-term investments in U.S. manufacturing facilities, research and development, and worker training, all of which have drastically reduced the cost of wind energy.

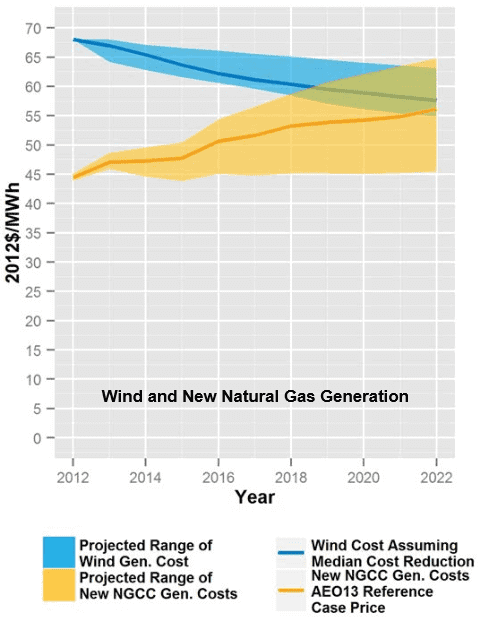

AWEA’s paper cites National Renewable Energy Laboratory (NREL) analysis which shows that the job is not yet done. As shown in the chart below, wind energy has not reached cost parity yet with conventional energy sources, which have benefited from far larger policy incentives for a longer period of time.

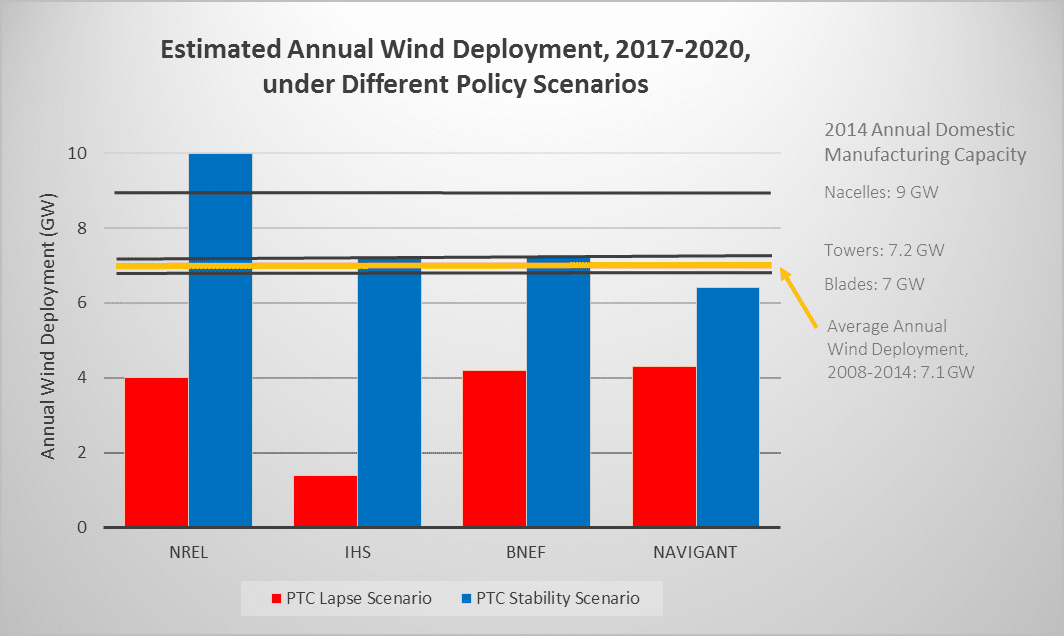

As a result, NREL, industry consultants, and other experts project the American wind industry would rapidly contract without further PTC extension, demonstrated in the second chart below. This policy uncertainty would put private sector investments in over 500 wind manufacturing facilities across 43 states at risk, along with tens of thousands of jobs. The last time Congress didn’t provide policy certainty, the industry was thrown off a cliff. Wind power investment dropped from $25 billion to $2 billion and 30,000 jobs were lost. This will happen again if Congress doesn’t act quickly this year and extend the PTC.

Data presented in Lazard’s analysis also support the conclusion that there is still work to do, concluding “a key question for industry participants will be whether these [renewable] technologies can continue their cost declines and achieve wider adoption without the benefit of subsidies.”

Lazard explains how the abrupt drop in natural gas prices has made it more difficult for renewable technologies in the current market, despite continued technological progress reducing clean energy costs. “Despite a sharp drop in the price of natural gas since last year’s LCOE, the costs of all forms of utility-scale solar photovoltaic and utility-scale wind technologies continue their dramatic declines.”

Natural gas prices are currently near record lows, in significant part due to complex but likely short-term dynamics driven by global oil prices, which are affecting the economics of oil and gas drilling in the United States. Lazard reduced its natural gas price assumption from $4.50/MMBtu last year to $3.50/MMBtu this year, but even that does not appear to be enough to keep pace with the short-term downturn in gas prices. The price of natural gas delivered to the electric sector has consistently been about 7.5% lower than Lazard’s $3.50/MMBtu assumption over the last five months. As a result, it is even more difficult for wind energy in the current market than indicated by Lazard’s figures.

This is not a reason to stay away from wind energy investment – in fact, such short-term variations in fossil fuel prices are actually one of the most compelling reasons to diversify our energy portfolio with stably-priced wind energy. A prudent investor knows to stay the course despite short-term fluctuations in the stock market, and Congress’s response to a temporary downturn in natural gas prices should be no different.

Recent analysis by the Department of Energy confirms that continuing to diversify our energy mix with stably-priced wind energy will make electricity prices 20 percent less sensitive to natural gas prices. A short-term example of this benefit was seen in January last year, when wind energy saved consumers $1 billion over just two days in the Great Lakes and Mid-Atlantic states alone, as natural gas prices skyrocketed and conventional power plants failed due to the extreme cold.

A number of utilities have also explained how stably-priced wind energy protects their consumers from fluctuations in fossil fuel prices. As Lazard itself notes, “The U.S. (and integrated electric systems globally) will continue to benefit from a balanced generation mix, including a combination of Alternative Energy and conventional generation technologies.”

Lazard’s report also notes other compelling reasons to invest in wind that are not currently compensated in our electricity market, such as wind’s valuable contribution to reducing costly air pollution.

For states and utilities currently assessing the best way to reduce carbon pollution for compliance with the Clean Power Plan, Lazard’s data show that wind energy is by far the lowest-cost generation option for reducing emissions, particularly compared to resources with emissions, like natural gas.

New information on the cost of energy storage also accompanied Lazard’s report. Lazard helpfully explains that energy storage provides a variety of services to the power system as a whole, and it is important to note that none of these services are directly related to the integration of wind energy.

As we’ve explained previously, energy storage is a system resource that can benefit all sources of supply and demand on the power system, with inflexible fossil and nuclear power plants typically receiving far more benefit from storage than wind energy.

There are also many options besides energy storage for obtaining the flexibility needed to operate the power system. Many, such as grid operating reforms, allow more efficient use of the power system and are lower in cost than adding new energy storage resources.

Overall, Lazard’s report provides helpful data that confirms the conclusions of AWEA’s PTC white paper. As AWEA CEO Tom Kiernan noted when the white paper was released in September, “The renewable energy PTC has been a tremendous success in driving technology improvements and cost reductions, but we need to finish the job. You don’t push a boulder 90 percent of the way up a hill only to stop a few feet short and let it roll back down.”

As Representative Tom Cole (R-OK) also explained in September when voicing his support for the wind Production Tax Credit, “You have to give any long-term investor a sense of stability so they can make calculations; these are significant investments. It’s not unusual for us to incentivize economic development through the tax code. If you’re traditionally in the oil and gas industry in Oklahoma, you’re pretty happy to have the completion allowance and intangible drilling cost deductions. Those things have been important not only in keeping domestic energy viable, but absent those, you wouldn’t have had the investments in fracking and horizontal drilling — things that literally have revolutionized energy production. The same thing is true here.”