Renewables on the grid: Putting the negative-price myth to bed

New, comprehensive analysis of electricity market price data confirms that renewable energy policies are not directly factored into electricity market prices.

Three years ago, the American Wind Energy Association (AWEA) rebutted arguments that occurrences of negative prices at nuclear plants in Illinois were frequently caused by wind energy. That “compelling” data led FERC Commissioner John Norris, who had previously discussed his concerns about negative prices, to affirm that “the focus on negative prices is a distraction.”

More recently, we have documented that many instances of negative prices are caused by conventional power plants.

AWEA has now made our prior analysis far more comprehensive by examining full-year 2016 price data for all retiring power plants in the main wholesale electricity markets that have a large amount of wind generation: PJM, MISO, SPP, and ERCOT.

The results, which we are releasing today for the first time, confirm that any instances of renewable policies like the Production Tax Credit (PTC) and state renewable standard credits being factored into market prices have a trivial impact on retiring power plants.

Across more than 1.8 million data points, which cover all 2016 pricing intervals in the day-ahead electricity market for all retiring power plants in those regions, only 55 instances of negative prices were found that could have been set by a wind project receiving the PTC. The analysis includes market price data for all power plants that have retired since 2012 or have announced plans to retire.

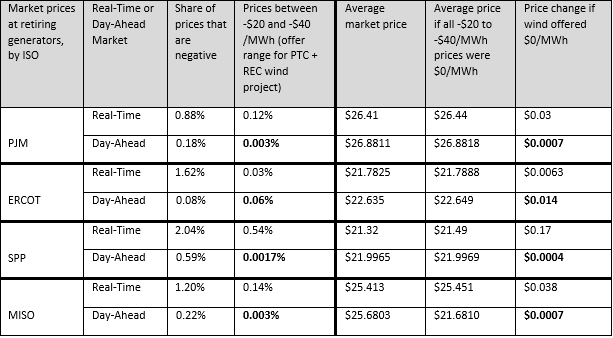

Our analysis focused on the day-ahead electricity market (the results bolded below), as that is where nuclear and coal generators sell most if not all of their generation. However, the results show that wind plants almost never set prices for an additional 2.4 million data points in the real-time electricity market as well. For more background on electricity markets and how prices are set, see the last section of this post.

In PJM and MISO, which account for a large share of all power plants in wholesale markets that are retiring nationwide, only 0.003 percent of day-ahead market prices at retiring power plants were in a range that could be set by a wind project receiving the PTC, as shown on the left side of the table. Occurrences of negative prices that could be wind-related were even less frequent in SPP, at 0.0017 percent of day-ahead market price intervals. Those occurrences were slightly more common at retiring plants in ERCOT, at 0.06 percent of price intervals, but it should be noted that there is only one retiring coal power plant in ERCOT.

To underscore the trivial impact of the PTC in setting market prices, the right side of the table shows how prices would change if wind projects receiving the PTC no longer received the credit. In PJM and MISO, conservatively assuming that all negative prices in that range were set by wind projects receiving the PTC, Day-Ahead Market prices at retiring power plants would increase by an average of $0.0007, or 1/13th of a penny per megawatt hour (MWh), if operating wind projects no longer received the PTC. Retiring power plants in SPP saw an even smaller impact at 1/25th of a penny, while the one retiring coal power plant in ERCOT saw an impact of around one penny per MWh.

To underscore the trivial impact of the PTC in setting market prices, the right side of the table shows how prices would change if wind projects receiving the PTC no longer received the credit. In PJM and MISO, conservatively assuming that all negative prices in that range were set by wind projects receiving the PTC, Day-Ahead Market prices at retiring power plants would increase by an average of $0.0007, or 1/13th of a penny per megawatt hour (MWh), if operating wind projects no longer received the PTC. Retiring power plants in SPP saw an even smaller impact at 1/25th of a penny, while the one retiring coal power plant in ERCOT saw an impact of around one penny per MWh.

It is important to clarify that the PTC does directly reduce consumer electricity costs outside of the electricity market. The PTC and other incentives allow wind projects to offer lower long-term contract prices to customers and the utilities who serve them, which translates into lower electric bills for consumers on a 1:1 basis.

However, those contract payments are outside of the wholesale electricity market, so they are not directly factored into the wholesale electricity market prices received by other generators.

The facts about energy incentives

In reality, the wind PTC has been a remarkable success in driving the American innovation and efficiency that have driven a two-third reduction in the cost of wind energy since 2009. The more than 102,500 Americans working in the wind industry today are creating a new industry with a bright future, bringing tens of billions of dollars in investment to rural areas and tens of thousands of manufacturing jobs to America. Production-based incentives like the PTC have driven efficiency increases that make U.S. wind projects some of the most productive in the world.

Regardless, Congress voted in December 2015 to phase down the wind PTC, and we are now in year three of that five-year phasedown period. Despite the recent focus on incentives for renewables, cumulatively wind energy has received only 3 percent of federal energy incentives, versus 86 percent for fossil and nuclear sources, according to the Nuclear Energy Institute and other experts. Given that the wind industry’s “tax reform” is already in place with the PTC phasedown legislation, we would welcome a comprehensive look at all forms of subsidies for all electricity sources.

Market dynamics are driving retirements

Market dynamics are benefiting consumers by driving retirement of older, less efficient resources in favor of more efficient resources. A wide range of experts agree that the primary factors driving power plant retirements and economic challenges for generators of all types are cheap natural gas and flat electricity demand.

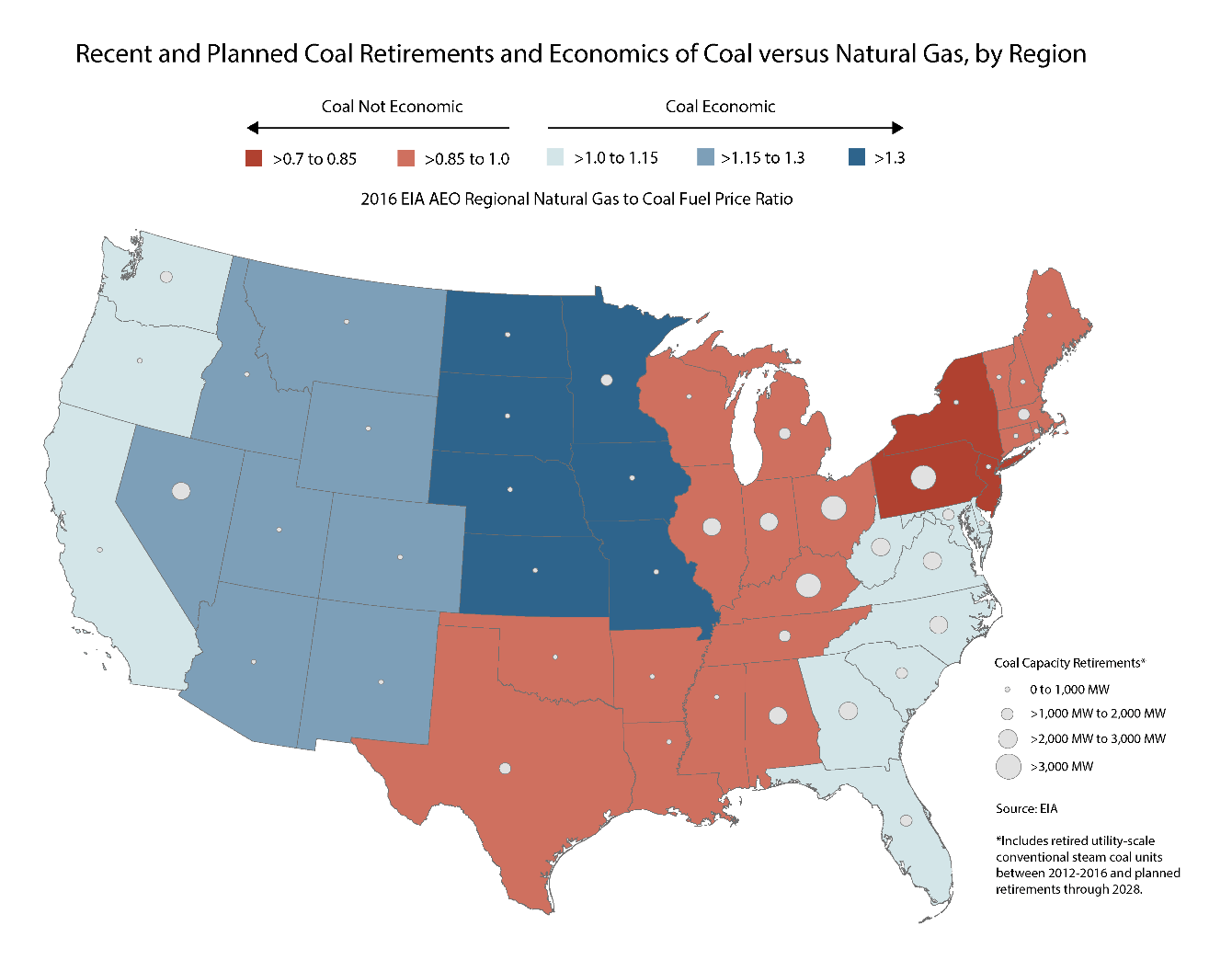

The following map, compiled from Department of Energy data, shows that most retiring coal and nuclear plants are in regions that have little to no renewable generation, confirming that renewable energy or pro-renewable policies cannot be the primary factor driving those retirements.

Rather, the primary factor driving power plant retirements appears to be low-cost shale gas production undercutting relatively high-cost Appalachian and Illinois Basin coal in the Eastern U.S., as shown below. In the regions shaded red in the map, the fuel cost of producing electricity from natural gas is significantly lower than the fuel cost of coal power plants, explaining why utilities in those regions are moving from coal to natural gas generation.

Rather, the primary factor driving power plant retirements appears to be low-cost shale gas production undercutting relatively high-cost Appalachian and Illinois Basin coal in the Eastern U.S., as shown below. In the regions shaded red in the map, the fuel cost of producing electricity from natural gas is significantly lower than the fuel cost of coal power plants, explaining why utilities in those regions are moving from coal to natural gas generation.

Economic theory explains why cheap gas, and not renewables, is primary factor driving retirements

Economic theory explains why cheap gas, and not renewables, is primary factor driving retirements

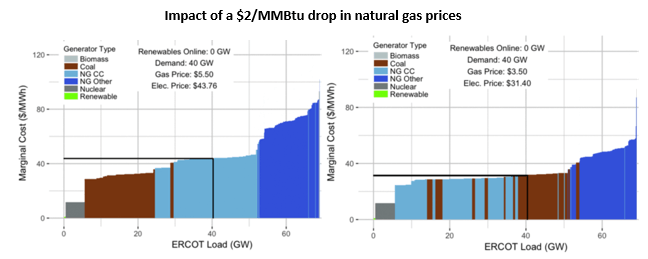

The outsized impact of cheap gas on electricity market prices, and the minimal impact of renewable energy and renewable energy policies, makes sense from an economics perspective. The regional grid operator PJM recently released material discussing how factors, including “sustained low natural gas prices,” have caused a “supply curve flip in which less flexible units formerly committed as base and mid-merit supply now are more regularly situated as the marginal resource needed to meet demand.”

PJM further explains how coal and nuclear plants are being challenged by an “[o]verall flattening of the supply curve, resulting from lower fuel costs in the growing natural gas generation fleet and increasing marginal costs of what previously had been thought to be ‘base load’ resources.”

This flattening and flipping of the supply curve can be seen in UT Austin’s modeling of the Texas electricity market. In this example, a $2/MMBtu drop in the price of natural gas reduces the electricity market price by $12.36/MWh. In the chart on the right, gas combined-cycle plants (in light blue), move to the left of many coal plants (in brown).

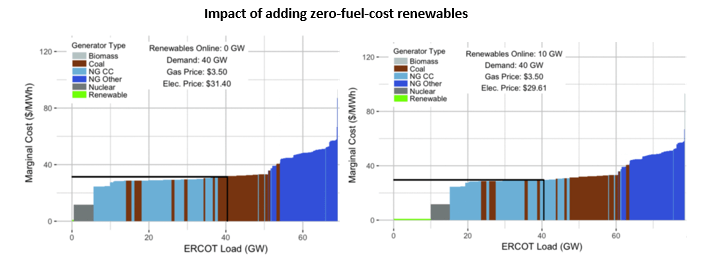

Renewable resources do reduce energy market prices, but they do not cause the supply curve to flip and they do not flatten the supply curve. Adding renewable energy pushes the supply curve out to the right, which does reduce energy market prices by allowing demand to be met by more efficient, less expensive power plants. In the example below, this impact is quite modest ($1.79/MWh, versus $12.36/MWh in the gas example above) when the supply curve is flat, as it is currently because of low natural gas prices.

Renewable resources do reduce energy market prices, but they do not cause the supply curve to flip and they do not flatten the supply curve. Adding renewable energy pushes the supply curve out to the right, which does reduce energy market prices by allowing demand to be met by more efficient, less expensive power plants. In the example below, this impact is quite modest ($1.79/MWh, versus $12.36/MWh in the gas example above) when the supply curve is flat, as it is currently because of low natural gas prices.

Renewables’ cost-reducing impact is both beneficial for consumers and market-driven, as it occurs regardless of the presence of pro-renewable energy policies. Renewable resources are able to offer into energy markets at very low cost because they have no fuel cost. Because they therefore enter on the far left side of the supply curve, they almost never set the market clearing price.

Renewables’ cost-reducing impact is both beneficial for consumers and market-driven, as it occurs regardless of the presence of pro-renewable energy policies. Renewable resources are able to offer into energy markets at very low cost because they have no fuel cost. Because they therefore enter on the far left side of the supply curve, they almost never set the market clearing price.

As a result, the price that other generation sources receive is unaffected regardless of whether renewable resources offer in at $0/MWh to reflect their zero fuel cost, or a lower offer price to reflect any incentives. This is a critical point for debunking common misconceptions about the frequency and causes of negative prices.