NERC, EIA, Bipartisan Policy Center: wind poised for record growth and major carbon-cutting role

AWEA’s John Hensley contributed to this analysis

Several new reports find wind energy is poised for record growth over the next several years, as utilities lock in historically low wind prices for their customers while also making a large down payment on required cuts to carbon pollution.

EIA and the Bipartisan Policy Center predict that the U.S. will roughly double its use of wind energy over the next five years, consistent with modeling released by NREL earlier this year and last year’s DOE Wind Vision scenario of wind providing 10 percent of U.S. electricity by 2020.

Utilities like Xcel and MidAmerican have already announced plans to start large wind deployments this year to maximize the federal Production Tax Credit (PTC) and take advantage of the more than 60 percent decline in wind energy costs since 2009. Many other utilities, including Tennessee Valley Authority (TVA), are moving aggressively to pursue large quantities of wind energy. However, utilities must act soon, as record low prices for wind energy are only available for wind projects that begin construction this year.

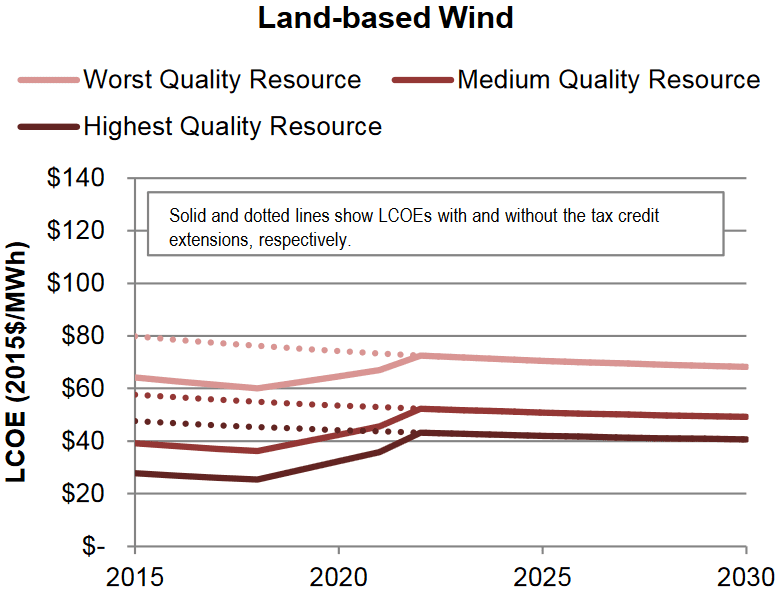

As shown in the following chart from NREL’s February report, time is of the essence for utilities seeking to lock in maximum value for their customers. Prices for wind purchases from projects that begin construction this year are likely to be at an all-time low, thanks to the combined impact of the full value PTC and recent wind cost reductions.

Under recently released IRS guidance, wind projects that qualify for the full PTC this year have until 2020 to come online. However, to qualify for the tax credit the wind project developer must make significant commitments this year. As a result, it is important for utilities to take steps this year, such as issuing Requests for Proposals and signing contracts to either buy wind projects or buy the output of those projects, so that wind project developers know how many wind projects to start construction on this year. Forward-looking utilities buying wind this year are likely locking in prices at the lowest point on that V-shaped price curve, as the value of stably-priced, zero-emission wind energy added to their portfolio today can only grow over the coming decades, as fossil fuel prices increase and carbon regulations are put in place.

EIA report

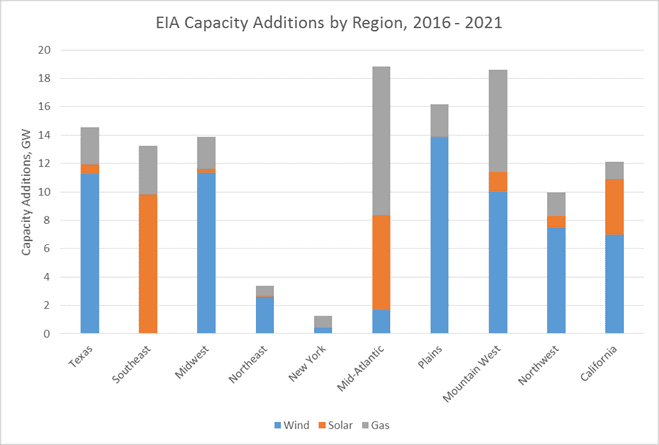

EIA’s report projects 66 gigawatts (GW) of wind deployment between now and 2021 (48 GW in a scenario without the Clean Power Plan), in addition to the approximately 75 GW currently installed in the U.S. Reflecting the increasing productivity of wind turbines, wind energy generation more than doubles to 452 billion kilowatt hours (kWh) in 2022, up from around 190 billion kWh last year.

EIA’s projected wind energy deployment is widespread across nearly every region of the country. Notably, this chart does not capture transfers of wind energy from one region to another, which are likely to grow as planned transmission projects deliver wind energy from high wind regions to other regions.

This year’s EIA report marks a notable upswing in projected wind deployment from previous EIA Annual Energy Outlook reports. This year, EIA updated cost and performance assumptions for wind energy, as previous versions had not kept pace with recent cost reductions, which EIA acknowledged on page 14 . The updated wind cost assumptions certainly contributed to the greater deployment of wind energy in this year’s report, along with the extension of the PTC at the end of last year.

However, a flaw in EIA’s assumptions causes it to still underestimate future wind energy deployment. Despite 60 percent cost reductions over the last 7 years, and NREL projections of 20 percent or more cost declines for wind energy through 2030, EIA inexplicably assumes that wind energy is a mature technology that only sees five percent cost reductions through 2035. Even stranger is that most other energy sources, like solar, nuclear, and even many types of gas generation, are assumed to experience many times larger cost reductions. As a result, EIA’s report still greatly underestimates wind energy deployment, particularly in the 2020’s and beyond.

NERC report

Similarly, NERC’s Aurora modeling projects the addition of 74 GW of new wind capacity between 2016 and 2030 in the no-CPP case, and an even larger amount in its IPM model runs. Both models show in excess of 500 billion kWh of wind energy generation in the year 2030 in the no-CPP case, around three times the amount of wind generation observed in recent years. Wind deployment further increases by around 20 GW in the CPP cases. Wind grows to provide 14.5 percent of the electricity generation mix in the year 2030 in NERC’s Aurora CPP modeling.

NERC’s renewable energy deployment projections are also markedly higher than its projections from last year, which relied on outdated assumptions about renewable energy cost and performance.

Bipartisan Policy Center

This week the Bipartisan Policy Center (BPC) also publicly presented modeling results showing a large deployment of wind energy over the next five years (slides should be posted here soon). By 2022, cumulative national wind deployment ranges from around 130 GW in a case without the CPP to around 155 GW in the highest CPP case, roughly a doubling from current levels. Across various scenarios, BPC’s results show wind energy averaging 400-525 billion kWh in the 2022-2032 time period, with the exact deployment depending on natural gas prices and assumptions about the CPP.

Others agree on large role for wind in CPP compliance

The Union of Concerned Scientists also released analysis last week projecting the deployment of 204 GW of new wind and solar capacity by 2030. Their modeling, which also included a large deployment of energy efficiency, showed over $30 billion in cumulative consumer savings through 2030.

Many states, utilities and grid operators continue to plan aggressively for CPP compliance, recognizing that large carbon pollution cuts are inevitable, due to market forces and the Supreme Court’s repeated affirmation of EPA’s authority and obligation to regulate carbon emissions. At a planning meeting in March, before temporarily suspending further work on the CPP, Iowa regulators heard modeling presentations from the Electric Power Research Institute, M.J. Bradley and Associates, the Midwest grid operator, and others, all confirming a large role for wind energy in cost-effectively meeting the CPP.

U.S. grid operators continue to plan for CPP implementation. For example, here are recent quotes from PJM Interconnection (PJM), the Southwest Power Pool (SPP), and the Midcontinent Independent System Operator (MISO), about move forward on planning for the Clean Power Plan:

- Denise Foster, PJM Interconnection Vice President for State and Member Services said states are “still interested in hearing from us what our results show from this Clean Power Plan analysis,” and “want to stay active with their peer group, thinking about what modeling efforts are out there and wanting to understand what those results are showing, because ultimately the stay could be lifted and they’d have to submit a plan.” (reported by E&E News, Rod Kuckro and Pete Behr, March 11)

- Lanny Nickell, SPP Vice President of Engineering said, “In our mind, it was a lot better for a state to have something they developed instead of allowing a federal plan to be imposed on them… some states are prevented legally from even talking about the Clean Power Plan…So we know that we can’t do anything about that, but as much as they can, if they can continue to think about it and be prepared for whatever future materializes, the better off they will be.” (reported by E&E News, Emily Holden, March 10)

- Jordan Bakke, MISO Senior Policy Studies Engineer said, ”Right now, we are looking at potential coal retirements out of the Clean Power Plan, how things on the renewable side would be changing and how those can be implemented into our regional processes…That’s because the primary thing that MISO’s seen is this trend toward less carbon generation going on into the future…Whether that means the Clean Power Plan or something else, our transmission development is designed to take that broad range of futures in and not simply plan toward the Clean Power Plan itself but plan for a future that is changing…We’re seeing very large resource changes on the system, and it is incumbent upon us to plan for that.” (reported by E&E News, Emily Holden, March 10)

States and utilities would be wise to follow grid operators’ lead in pro-actively planning for the generation mix of the future. Thanks to its record-low pricing and fuel price stability, wind is a “no regrets” solution for a state or utility looking to diversify its energy portfolio, regardless of when and how carbon regulations are ultimately implemented. However, due to the short-term availability of federal tax credits, utilities must act now or they will miss a once in a lifetime opportunity to lock in record low wind prices.