Largest U.S. grid operator finds wind energy saves consumers money under EPA’s Clean Power Plan

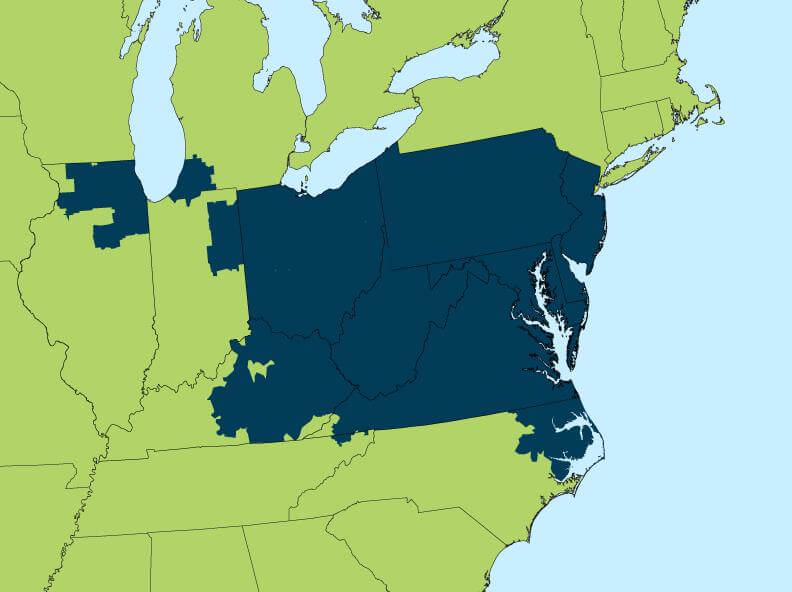

Map of the area served by the grid operator PJM

Using wind energy will reduce the cost of complying with EPA’s Clean Power Plan by billions of dollars, particularly if natural gas prices increase, according to detailed new analysis released this week by PJM, the grid operator for 60 million people in 13 Mid-Atlantic and Great Lakes states.

PJM compared scenarios in which PJM states fully met their Renewable Portfolio Standard (RPS) requirements versus a lower scenario in which only currently planned renewable plants were built, reducing the amount of available renewable energy by around 20 million MWh per year, enough to supply roughly 2 million typical homes. With more renewable energy available, the cost of operating the power system under EPA’s Clean Power Plan decreased by around $200 million in 2020, $800 million in 2025, and $1.2 billion in 2029, while wholesale electricity costs for consumers decreased by $2.4 billion in 2025 and $4.1 billion in 2029. Those results are summarized in the PJM charts copied at the bottom of this post.

PJM’s analysis further broke those results out by state, as summarized in the table below:

|

For the year 2029, millions of dollars |

Wholesale consumer electricity cost without RPSs met |

Wholesale consumer electricity cost with RPSs met |

Gross annual savings from PJM states meeting RPSs |

|

Delaware |

$804 |

$749 |

$55 million |

|

Illinois (PJM portion) |

$6,462 |

$5,921 |

$541 million |

|

Indiana (PJM portion) |

$1,188 |

$1,088 |

$100 million |

|

Kentucky (PJM portion) |

$877 |

$805 |

$72 million |

|

Maryland |

$4,249 |

$3,947 |

$302 million |

|

Michigan (PJM portion) |

$222 |

$204 |

$18 million |

|

New Jersey |

$5,046 |

$4,698 |

$348 million |

|

North Carolina (PJM portion) |

$485 |

$448 |

$37 million |

|

Ohio |

$9,229 |

$8,469 |

$760 million |

|

Pennsylvania |

$10,096 |

$9,369 |

$727 million |

|

Virginia |

$7,681 |

$7,132 |

$549 million |

|

West Virginia |

$1,990 |

$1,828 |

$162 million |

|

Total |

$48,329 |

$44,658 |

$3.671 billion |

PJM also found that the benefits of renewable energy were even more pronounced in a scenario with higher natural gas prices, as shown in the tables below. PJM found a combination of greater use of renewable energy, energy efficiency, and new gas generation provided gross production cost savings of $1.6-2.3 billion per year under its base gas price assumption, while those savings grew to $2.3-3.8 billion per year if natural gas prices were 50 percent higher. PJM’s base gas price trajectory assumption is taken from industry consultant Ventyx’s latest data release. (Tables drawn from PJM Figures 14 and 16)

Base natural gas prices, $ billions in annual production costs (cost of operating power plants)

|

2020 |

2025 |

2030 |

|

|

RPSs met, more EE and gas capacity |

$20.1 |

$23.2 |

$26.6 |

|

RPSs not met, less EE and gas capacity |

$21.7 |

$24.9 |

$28.9 |

|

Gross savings (billions) |

$1.6 |

$1.7 |

$2.3 |

50% higher natural gas prices, $ billions in annual production costs

|

2020 |

2025 |

2030 |

|

|

RPSs met, more EE and gas capacity |

$22.5 |

$27.7 |

$32.0 |

|

RPSs not met, less EE and gas capacity |

$24.8 |

$30.5 |

$35.8 |

|

Gross savings (billions) |

$2.3 |

$2.8 |

$3.8 |

The gross wholesale consumer savings from the use of renewable energy, energy efficiency, and new gas capacity were found to be even larger than the above savings for power system production costs. The combination of greater use of renewable energy, energy efficiency, and new gas generation reduced consumer wholesale electricity costs by $15.2-19.4 billion per year under its base gas price assumption. Those savings grew to a whopping $39.7-54.9 billion per year if natural gas prices were 50 percent higher. (Drawn from PJM Figures 12 and 13)

Base natural gas prices, $ billions in annual consumer wholesale electricity costs

|

2020 |

2025 |

2030 |

|

|

RPSs met, more EE and gas capacity |

$31.9 |

$42.0 |

$50.6 |

|

RPSs not met, less EE and gas capacity |

$47.1 |

$63.6 |

$70.0 |

|

Gross savings (billions) |

$15.2 |

$21.6 |

$19.4 |

50 percent higher natural gas prices, $ billions in annual consumer wholesale electricity costs

|

2020 |

2025 |

2030 |

|

|

RPSs met, more EE and gas capacity |

$31.9 |

$44.4 |

$54.7 |

|

RPSs not met, less EE and gas capacity |

$71.6 |

$93.7 |

$109.6 |

|

Gross savings (billions) |

$39.7 |

$49.3 |

$54.9 |

PJM’s analysis does not include the cost of renewable energy purchases, which are typically made outside of the wholesale electricity market. However, on a $/MWh basis the savings attributable to wind are significantly greater than the cost of wind, based on the average price for recent wind power purchase agreements in the Great Lakes region. This indicates that adding wind energy would provide net benefits to PJM consumers.

This finding was confirmed by a May 2013 report by Synapse Energy Economics that found doubling use of renewable energy in PJM from existing state RPS requirements would save consumers a net $6.9 billion per year, after accounting for the cost of wind and transmission as well as the value of carbon emissions.

PJM’s new analysis also refutes concerns that have been raised about electric reliability. PJM found that the high renewable scenario had significantly fewer power plants (2,324 MW) at risk of retirement than the low renewable case in the year 2025, while for the years 2020 and 2029 the high renewable case had slightly more plants at risk (155 MW and 174 MW). PJM attributes this difference (shown in Figure 28 in PJM’s analysis) to the interaction of a variety of factors, with the primary one being that by reducing emissions, renewable energy reduces the compliance burden on other parts of the electric sector.

As AWEA has pointed out, adding non-emitting resources like wind provides states and utilities with greater flexibility to meet EPA’s Clean Power Plan than the addition of resources that have some emissions. For example, a state or utility would have to substitute far more MWh of gas generation for coal generation to achieve the same level of emissions reductions than if zero emission wind generation were used instead. In other words, using more natural gas for compliance will likely result in more coal plant closures, whereas using more wind energy allows for a more balanced portfolio for compliance. Greater use of wind energy will therefore result in less disruption to the existing generating fleet, reducing any cost or reliability concerns about meeting the Clean Power Plan.

Finally, PJM’s findings about the benefits of wind are likely to be conservative. PJM’s analysis assumes that EPA will allow new gas power plants to be credited as zero-emission resources for purposes of Clean Power Plan compliance, even though new gas generators obviously have sizeable emissions. It is widely expected that EPA will close this “loophole” that would allow new gas generation to be credited as a zero-emitting resource. The value of wind for cost-effectively reducing emissions is therefore likely to be even greater than indicated in PJM’s analysis. That is both because more emissions reductions will be required than PJM expects and because wind looks relatively more attractive if new gas is not treated as having zero emissions.

As discussed at the beginning, the following two charts from PJM’s analysis show the production cost and consumer electricity cost benefits of renewable energy.

The cost of operating the power system is lower if state RPS requirements are met (OPSI 2a) than if fewer renewables resources are available (OPSI 2b.1):

Consumer wholesale electricity costs are lower if state RPS requirements are met (OPSI 2a) than if fewer renewables resources are available (OPSI 2b.1):