Koch Professor drops his Koch title, still makes same errors plus some new ones in Ohio study

The Koch Professor’s title isn’t the only thing that’s changed after facing negative publicity. Randy Simmons and his colleagues, including Ryan Yonk who is testifying at a hearing in Ohio today, also changed their methodology from what they’ve previously used in their cookie-cutter attacks on clean energy, while still using old data. Interestingly, using the methodology they used for their Kansas report earlier this year, but with updated data for Ohio, would have shown that renewable energy brings significant consumer savings and job creation to Ohio. Instead, for today’s presentation they adopted a new methodology that includes even more flaws than their previous method and compound it by using out of date information as their data set.

Using their old methodology, but with more recent data, shows wind energy creates jobs and benefits Ohio consumers

Using updated data that accounts for recent reductions in the cost of wind energy, the methodology used in the authors’ Kansas report actually shows wind energy provides significant consumer benefits and job creation benefits. Using their old method with similar updates for Ohio would have also shown significant net benefits. Specifically, their method used Energy Information Administration (EIA) data which shows that wind energy in Ohio provides economic value of $63.60/MWh. This value provided by wind energy is higher than the cost of wind energy as reflected in recent utility wind purchase agreements, which average $47/MWh in Ohio.

Because the average value of wind energy is greater than its cost in Ohio, their method would have shown that wind energy provides net savings to consumers. While Simmons, Yonk, and their colleagues did not provide the precise cost assumptions or intermediate results used in their Ohio analysis, we were able to back-calculate those assumptions from their final results. This back-calculation reveals that they assumed renewable energy costs $16.43/MWh more than conventional energy, while using their Kansas method with updated data for Ohio would have shown that wind energy provides net savings of $16.60/MWh. As a result, we are able to correct their projections for the economic impact of renewable energy use in Ohio, working directly from the table included in their report:

Impact of renewable energy use in Ohio

| Total net electric bill savings in 2026 | $284 million |

| Electricity price decrease in 2026 | .20 cents/kWh |

| Percentage decrease in electricity prices | 1.88% |

| Total employment increase | 3,672 |

| Investment increase | $53 million |

| Disposable income increase | $261 million |

–

Interestingly, Simmons, Yonk, and their colleagues declined to use their Kansas method in Ohio. Instead, they opted to use even more obsolete data as the inputs into their analysis. Instead of only going back to EIA’s 2013 renewable cost estimates like they did in their Kansas report, in their Ohio report they go back to 2008 cost data to develop their estimate of how the cost of wind energy compares against alternatives.

No explanation is provided for why they did not use EIA’s more recent 2015 and 2014 data, which show that wind energy imposes no net cost relative to conventional sources of energy even after removing the impact of federal incentives. Of course, the authors could have also used recent data from real-world market prices and found that wind energy provides significant net benefits for consumers, as we did above. Instead, using obsolete data allows them to miss how the cost of wind energy has fallen by more than half over the last five years, as documented by both government and private investor data.

Ohio report still tries to blame the RPS for causing the 2008 global financial collapse

The second part of the Koch authors’ Ohio report repeats the same trick used in their other reports, though their chicanery is particularly egregious in the case of Ohio. Relying on the fallacy that “correlation equals causality,” the authors use the fact that Ohio enacted its RPS in May 2008 to blame the RPS for causing a massive economic collapse that occurred in the fall of 2008.

Of course, every state experienced a massive economic downturn in the fall of 2008, caused by the global financial collapse. The authors never attempt to account for the impact of outside events like the global financial collapse, never explain the contradiction that this method produces results 75 times larger than the results they found under their seriously flawed first method discussed above, never explain how the RPS could have caused an electricity price increase that is orders of magnitude larger than the cost cap mandated in Ohio law, never offer an explanation for how the RPS could possibly cause a 10 percent jump in the unemployment rate in the fall of 2008 when the first large-scale renewable energy projects were not placed online until 2011, and never attempt to explain their strange finding that RPSs that were enacted after the 2008 collapse in other states were somehow to blame for causing an economic collapse that occurred nearly a year prior to their enactment. (The authors even note, but fail to resolve, the fatal problem that “the evidence from the event study warrants further exploration into the effects, since state economies also appear to decline several months prior to the enactment of an RPS.”)

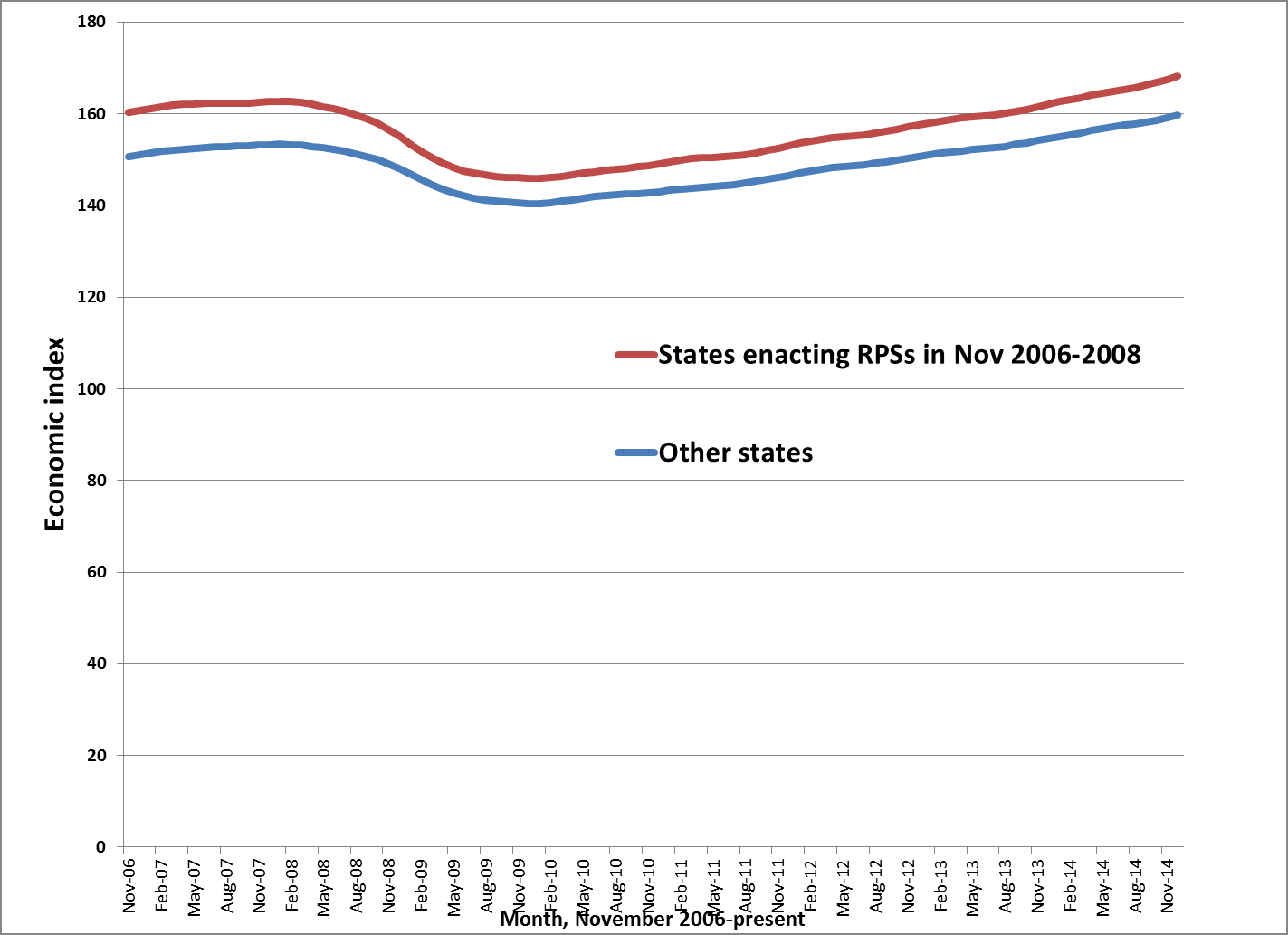

The authors could have used basic statistical methods to control for the impact of outside events like the 2008 financial crisis and isolate the actual impact of RPS enactment in Ohio and other states. This can be done by simply comparing the economic performance of states with an RPS against states without an RPS. As shown below, this shows that states with RPSs fared better before the global financial collapse and continued to fare better after the collapse, while all states were comparably affected by the collapse. This use of a control group is the fundamental principle used in most scientific and statistical inquiry, so the authors’ departure from established statistical practices is unusual.

Conclusion

Instead of relying on a grossly flawed attack piece, Ohio should look to the dozens of studies by independent grid operators, state governments, and academic experts that have found that wind energy benefits consumers by reducing electricity prices. DBL Investors recently released a detailed analysis confirming that states with the most renewable energy have lower electricity prices than other states, and that states with RPSs have seen lower electricity price increases than states without RPSs. Finally, analysis using PJM grid operator data indicates that stably-priced wind energy saved consumers in Ohio and neighboring states $1 billion when electricity and natural gas prices spiked during the January 2014 polar vortex.