Fact Check: Cheap gas, not renewables, primarily depressing power prices

Last week, the electric grid operator for the Mid-Atlantic and Great Lakes states (PJM) proposed a reform to its energy market rules to address concerns that prices are too low. There has been some confusion regarding why PJM felt the reform was necessary, with some incorrectly claiming it was primarily caused by renewable energy or pro-renewable energy policies.

However, PJM’s proposal and background material clearly state that PJM believes the change is needed because several factors, including “sustained low natural gas prices,” have caused “A supply curve flip in which less-flexible units formerly committed as base and mid-merit supply now are more regularly situated as the marginal resource needed to meet demand.”

PJM further explains that the reform is needed because of an “Overall flattening of the supply curve, resulting from lower fuel costs in the growing natural gas generation fleet and increasing marginal costs of what previously had been thought to be “base load” resources,” and “Diminishing energy market returns to resources resulting in a shift to the capacity market for a greater proportion of units’ recovery of their total costs.”

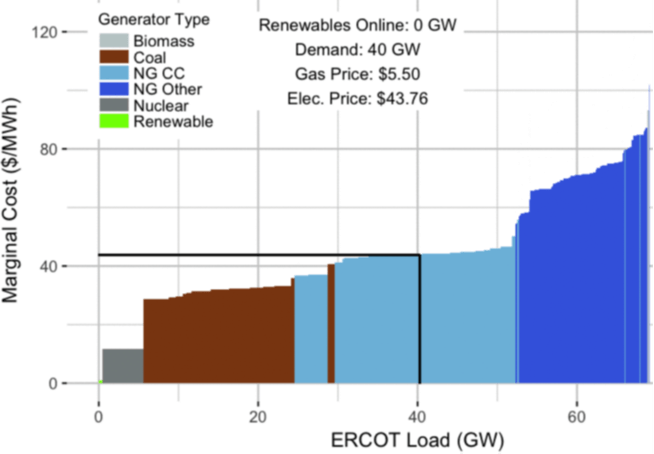

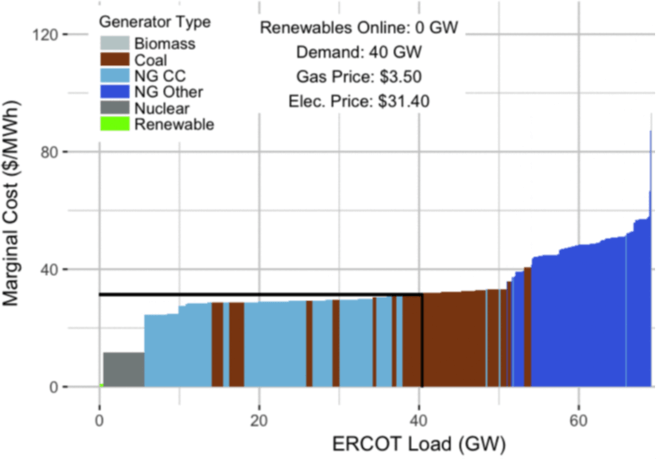

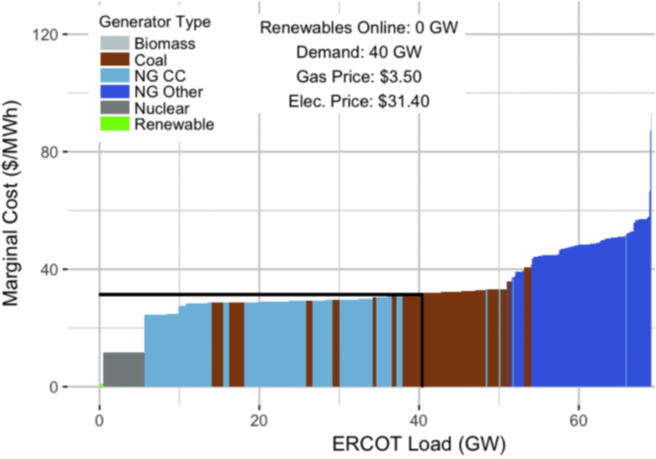

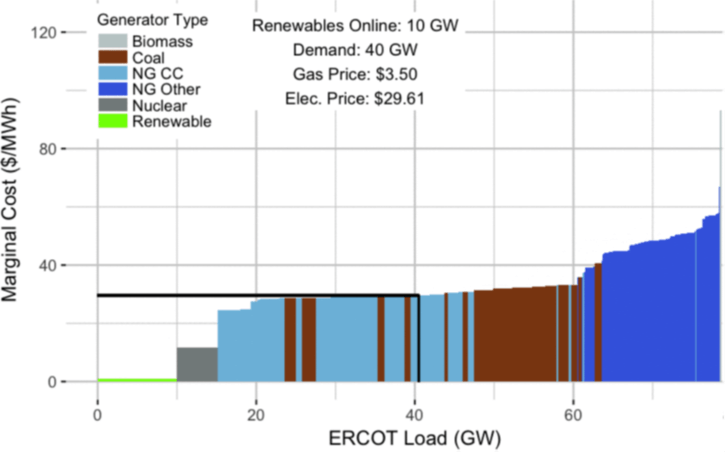

Low natural gas prices challenging the economics of inflexible resources (i.e.: coal and nuclear) is the only factor that could have caused a supply curve flip and a flattening of the supply curve. To illustrate, the change from the first chart to the second chart below shows how lower natural gas prices reduce electricity prices and challenge other generators by flattening the supply curve and flipping the supply curve so gas generators fall below the cost of other generators (gas combined cycle plants [light blue] move to the left of many coal plants [brown] in the second chart). In this example, taken from UT Austin modeling of the Texas electricity market, a $2/MMBtu drop in the price of natural gas reduces the electricity market price by $12.36/MWh.

Because low natural gas prices have undercut the economics of coal power plants, in many hours coal power plants are now the most expensive generators operating in PJM, and therefore would set the energy market price for all resources in the market. However, current market rules in PJM do not allow prices to be set by “inflexible resources” that cannot quickly increase or decrease their output in response to market signals, a category that includes many coal power plants and nuclear power plants. This is the concern PJM is proposing to address by allowing inflexible resources to set the energy market clearing price. AWEA has supported similar proposals in the past.

Renewable resources do reduce energy market prices, but they do not cause the supply curve to flip and they do not flatten the supply curve, indicating renewables are not the primary cause of the concerns PJM is attempting to address. Adding renewable energy pushes the supply curve out to the right, which does reduce energy market prices by allowing demand to be met by more efficient, less expensive power plants. In the example below, this impact is quite modest ($1.79/MWh, versus $12.36/MWh in the gas example above) when the supply curve is flat, as it is currently because of low natural gas prices.

It is important to clarify that this impact of renewables is both beneficial for consumers and market-driven, as it occurs regardless of the presence of pro-renewable energy policies. Renewable resources are able to offer into energy markets at very low cost because they have no fuel cost. Because low-fuel-cost renewable resources enter on the far left side of the supply curve, they almost never set the market clearing price. As a result, it does not matter whether renewable resources offer in at $0/MWh to reflect their zero fuel cost, or a lower offer price to reflect any incentives.

Confusion over negative prices

Some of the confusion over the reasoning for PJM’s proposed reform appears to have stemmed from a separate item that PJM discussed at the end of same document. In contrast to the specific energy market reform proposed above, in that section of the document PJM simply proposes to initiate a “broader discussion” with stakeholders and others regarding the impact of negative price offers in the PJM market. For the reasons explained above, renewable resources could not have caused the supply curve flip and flattening that PJM cites as the primary factors making its proposed energy market reform necessary.

Regarding PJM’s proposed discussion of negative prices, we agree with former FERC Commissioner John Norris and others that focusing a discussion on negative prices is a “distraction” from the real challenges facing electricity markets. As we’ve explained previously, negative prices are extremely rare, getting rarer as transmission upgrades are completed, and are seldom caused by wind energy. When they do occur, they typically happen in isolated areas and have little to no impact on other generators.

As Commissioner Norris concluded, “Transmission development is the better, and more proactive, solution to negative pricing….” Upgrading the grid, carbon pricing, and market-based reforms to bring more costs into energy markets and fully compensate resources for the services they provide are the real solutions for ensuring the viability of efficient generation resources, reforms wind and conventional generators should be working together to implement.

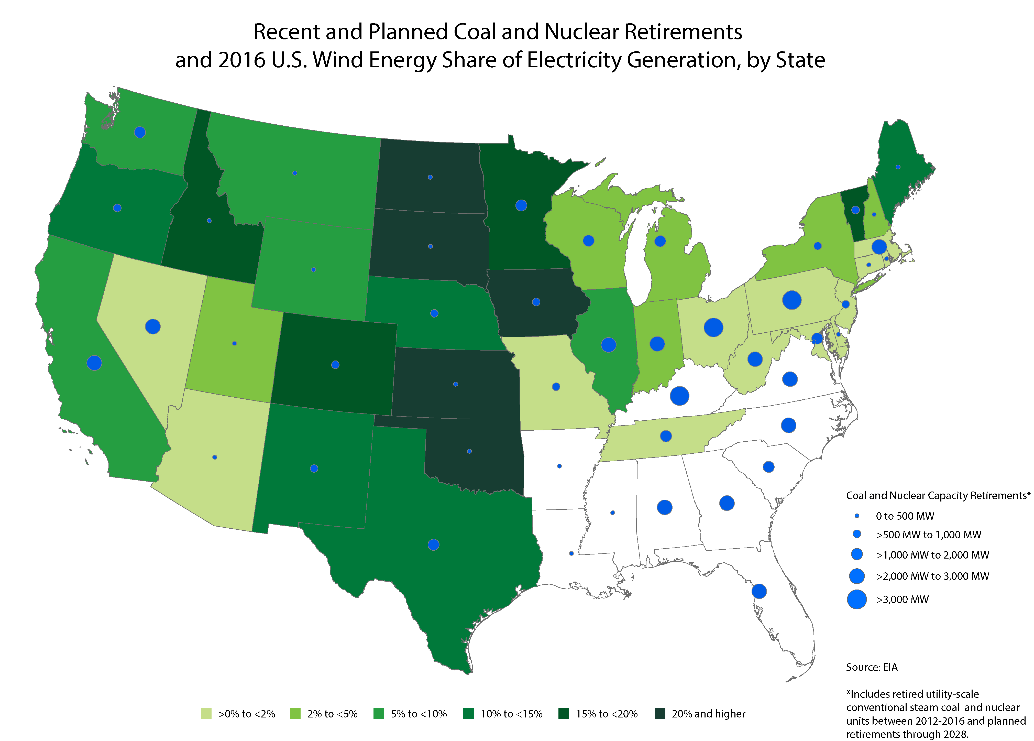

Unfortunately, the misconception that renewable resources or policies are the primary factor causing economic challenges at coal and nuclear plants has received attention lately. Some of the clearest evidence that wind energy is not the main factor driving other energy sources’ market woes can be seen just by looking at where coal and nuclear power plants are retiring. Most retiring coal and nuclear plants are in areas that have little to no wind generation, as shown below.

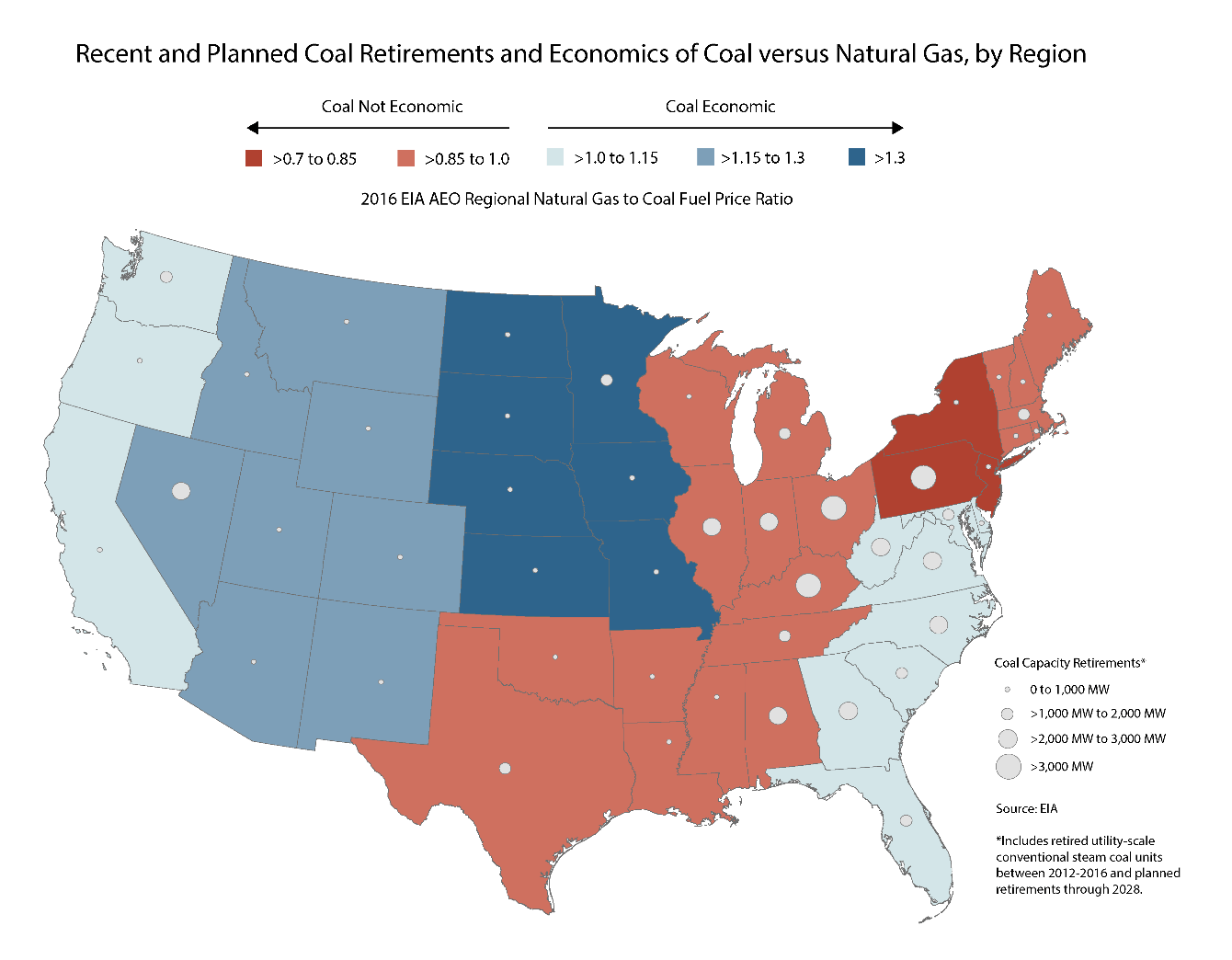

Rather, the primary factor driving power plant retirements appears to be low-cost shale gas production undercutting relatively high cost Appalachian and Illinois Basin coal in the eastern U.S., as shown below. In the regions shaded red in the map, the fuel cost of producing electricity from natural gas is significantly lower than the fuel cost of coal power plants, explaining why utilities in those regions are moving from coal to natural gas generation.

Conventional energy sources enjoy market preferences

PJM’s proposed market reform is also notable in that it can be viewed as a market preference to help accommodate inflexible generating resources, mostly coal and nuclear plants that cannot quickly change their output. Like many coal and nuclear plants, wind plants typically operate at their maximum available output because their cost of producing energy is so low. Unlike many coal and nuclear plants, however, wind plants quickly and accurately reduce their output in response to market signals, and wind plants can increase their output with similar speed once their output has been dispatched down. As PJM notes in its proposal, it is important that any market reform maintain the incentive for generators to be flexible and respond to price signals.

Other preferences for inflexible resources are embedded in existing market rules. For example, the very existence of the day-ahead energy market and the day-ahead commitment of resources in all Independent System Operator markets can be traced to the fact that some energy sources have limited flexibility to change their output or must purchase fuel in advance. As a thought experiment, a power system composed mostly of flexible resources with free fuel like wind, solar, hydropower, and storage would likely not need a day-ahead market or day-ahead commitment as there are no irreversible decisions that must be made in that timeframe.

Large inflexible conventional generators impose other costs on the power system. Researchers have documented how low-cost, inflexible generators force other resources to operate more flexibly and incur costs associated with cycling. Another notable example is the billions of dollars spent on fast-acting contingency reserves that are held 24/7 to ensure the lights stay on in case a large fossil or nuclear plant experiences a sudden outage. This cost is currently socialized across ratepayers, even though the need for these reserves is set by the size of large power plants and not by smaller generators like renewable resources. Large conventional generator outages also make it necessary for other conventional generators to provide even faster primary frequency response. Making matters worse, NERC has found that around 90 percent of conventional generators fail to provide sustained primary frequency response.

Those looking for special preferences in market rules are unlikely to find any for renewable resources, but ironically are likely to find many for conventional generators. Just as many are unaware that permanent subsidies for fossil fuels vastly outweigh incentives for renewable energy because permanent subsidies are less visible than temporary tax credits for renewable resources, long-standing market rule preferences for conventional generators are often overlooked.