#AmericanWindWeek: Offshore wind powers the opportunity for a new ocean energy resource

Day 5 of #AmericanWindWeek is here, and today’ we’re celebrating a new ocean energy resource: offshore wind. Interest in offshore wind has exploded in the three years since the Block Island Wind Farm became the first U.S. offshore wind project. States up and down the East Coast have made big commitments to offshore wind, and there are intriguing projects in the works off California’s coast and the Great Lakes. And just in time for #AmericanWindWeek, the Department of Energy (DOE) has a new report that explores the state of offshore wind.

While land-based wind is well established in the United States, offshore wind represents a huge opportunity to build out a new American industry. That means tens of thousands of new jobs and the potential to create a new American supply chain that could be a $70 billion opportunity. The federal government has issued 15 active offshore wind energy leases to date, bringing in over $472 million to the U.S. treasury. States are driving strong demand for offshore wind and have established nearly 22,000 megawatts (MW) of offshore wind procurement targets to date.

Earlier this week DOE released its 2018 Offshore Wind Technologies Market Report, highlighting increasing interest and competition in the U.S. offshore wind market, project advancements, cost reductions, and technology trends in the United States and around the world. Here’s a look at the big takeaways:

U.S. offshore pipeline

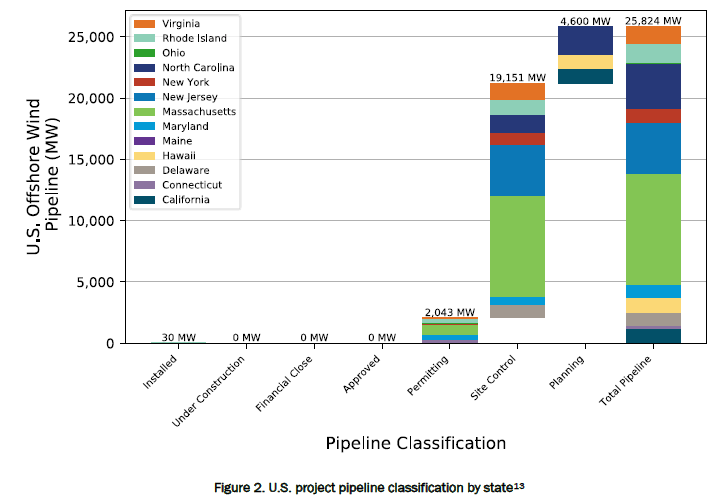

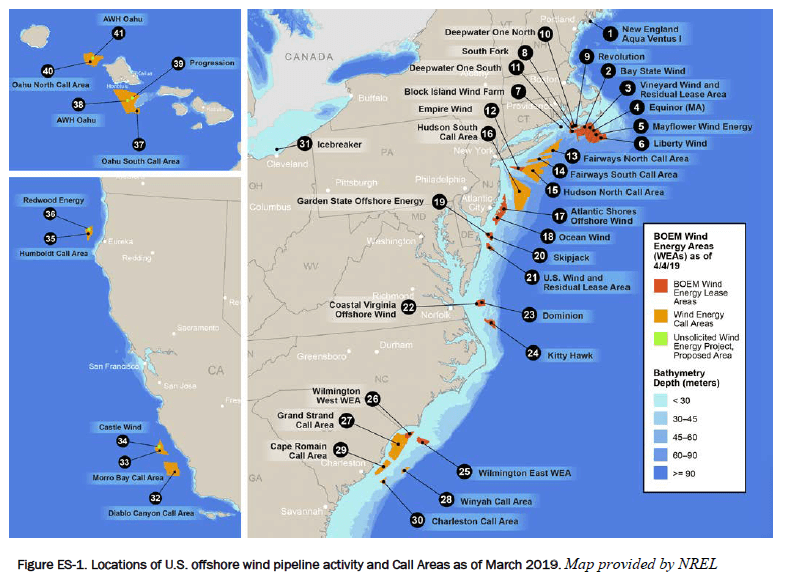

- According to the report, the U.S. offshore wind pipeline stood at over 25,824 MW of potential capacity at the end of 2018. This pipeline includes 30 MW of installed capacity, nine projects (2,043 MW of capacity) at the permitting stage with an offtake contract or pathway to obtaining a contract, 19,151 MW of potential capacity where developers have exclusive site control of a lease area, and 2,250 MW of potential capacity in unleased wind energy areas. The pipeline also includes five projects totaling 2,350 MW in the Pacific region that have submitted applications to the Bureau of Ocean Energy Management (BOEM) in places where wind energy areas have not yet been identified.

- Planned U.S. offshore wind projects made significant advancements in 2018. As of the end of 2018, four projects had submitted construction and operations plans, nine projects received site assessment plan approvals, and six projects had signed power offtake agreements. Recent industry forecasts estimate that 11 to 16 gigawatts (GW) could reach operation by 2030.

Increased interest & competition in the U.S.

Additional state-level policy commitments and increased interest in the U.S. market drove strong competition for offshore wind leases in 2018. BOEM auctioned three wind lease areas off Massachusetts in December 2018, with each winning bid reaching $135 million. These bids more than tripled the previous record for a single lease area of $42 million for a lease off New York in 2016. In December 2018, Atlantic Shores Offshore Wind, a partnership between EDF Renewables and Shell New Energies, purchased an existing lease off New Jersey from US Wind for $215 million (pending regulatory approval). On the other side of the country, BOEM issued a call for interest in three commercial wind energy leases off California and received 14 nominations from companies interested in developing off California’s coast. BOEM is also continuing to examine commercial interest for new Call Areas in the New York Bight.

Cost and pricing trends

Cost and pricing trends

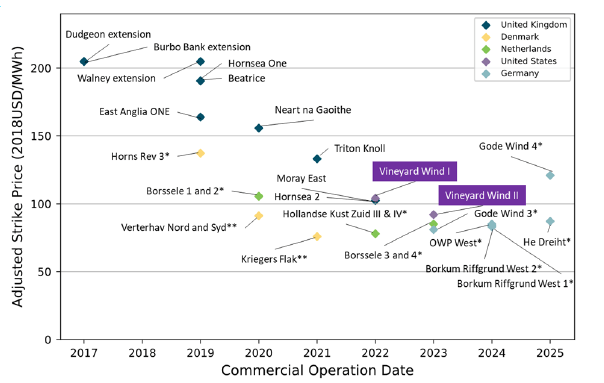

- In 2018, Vineyard Wind’s contract with Massachusetts electric distribution companies provided the first reference point for the price and cost of large-scale offshore wind projects in the U.S, coming in at a lower price than previously expected. The price for the first 400 MW of the project is $74/MWh, while the second 400 MW came in at $65/megawatt hour (MWh).

- Globally, prices from 2018 auctions demonstrated further cost reductions for offshore wind. Prices have declined from approximately $200/MWh for 2017-2019 COD projects to roughly $75/MWh for projects that will reach operation in 2024-2025. These reductions have been driven by a combination of increased project size, favorable siting characteristics, optimization of technology and installation processes, and increased supply chain competition, among other factors.

Offshore wind technology trends

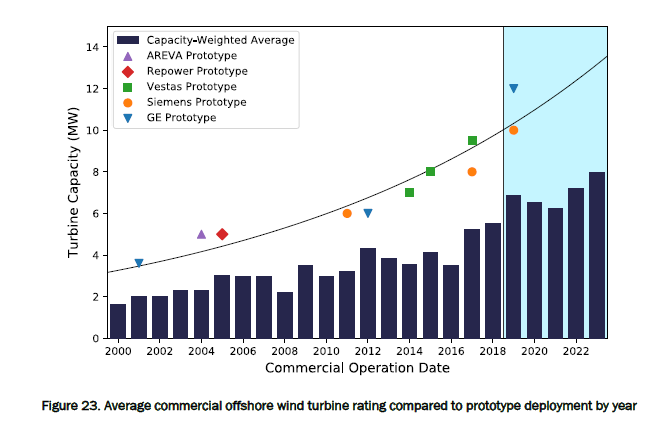

Offshore wind turbines are much larger than their land-based counterparts, with a capacity-weighted average size of 5.5 MW in 2018. The offshore wind industry is developing larger and larger turbines with capacities over 10 MW to reduce costs and increase energy output. MHI Vestas’ V174-9.5 is currently the largest machine in the commercial market. Future turbines will be even larger, with capacities increasing to 12 MW or even 15 MW in the next decade. Siemens Gamesa announced a 10 MW direct drive turbine with a 193-meter rotor diameter that will be market-ready by 2022, and GE is developing a 12 MW turbine that will be on the market by 2021.

Floating offshore wind technology is advancing as well, and once this technology matures it will open new areas in deep water for development that are currently inaccessible with existing technology, including California and Hawaii in the U.S. There are currently eight pilot and demonstration floating wind projects totaling 46 MW operating around the world. Five of these projects are in Europe and three are in Asia. Looking forward, 14 small-scale floating projects totaling roughly 200 MW are under construction or have achieved either financial close or regulatory approval across nine countries. When including projects in the early planning stages, the global floating offshore wind pipeline stood at 4,888 MW at the end of 2018. The first large-scale floating projects are expected to become commercially viable after 2022.

Floating offshore wind technology is advancing as well, and once this technology matures it will open new areas in deep water for development that are currently inaccessible with existing technology, including California and Hawaii in the U.S. There are currently eight pilot and demonstration floating wind projects totaling 46 MW operating around the world. Five of these projects are in Europe and three are in Asia. Looking forward, 14 small-scale floating projects totaling roughly 200 MW are under construction or have achieved either financial close or regulatory approval across nine countries. When including projects in the early planning stages, the global floating offshore wind pipeline stood at 4,888 MW at the end of 2018. The first large-scale floating projects are expected to become commercially viable after 2022.

Highlights from yesterday

I’m proud that Illinois is one of the leaders in wind energy, which attracts billions in investments & supports over 7,000 jobs across our state. Wind energizes our economy & creates good-paying jobs, all while protecting our environment for future generations. #AmericanWindWeek

— Tammy Duckworth (@SenDuckworth) August 15, 2019

.@ChuckGrassley in the @globegazette: This week marks #AmericanWindWeek and I can think of no better state than Iowa to hold up as an example of what can happen when we embrace wind energy. https://t.co/uX0t8UW5YC

— Sen. Grassley Press (@GrassleyPress) August 15, 2019

When sustainability and metal converge 🤘🏽#AmericanWindWeek #MetalMayor pic.twitter.com/bJPfyVMZH9

— Mayor Tim Keller (@MayorKeller) August 15, 2019

Wind power is an integral part of San Diego’s energy portfolio. As innovative companies invest in wind power technology, it creates jobs and brings us closer to our clean energy goals. #AmericanWindWeek pic.twitter.com/76RGfX2Rii

— Rep. Scott Peters (@RepScottPeters) August 14, 2019

Team Wanzek is in Kulm, ND to celebrate with @xcelenergy their #FoxtailWind project. We look forward to continuing our strong partnership. #AmericanWindWeek pic.twitter.com/V5JUlHDdBN

— Wanzek Construction (@WanzekConst) August 15, 2019

Thank you to our partners @XcelEnergyMN and @BlattnerEnergy,

local and state officials, and the Pipestone community for joining us to celebrate

the construction of the state’s newest wind energy center, the Lake Benton II

Wind project. #AmericanWindWeek pic.twitter.com/My5bzfD0TL— NextEra Energy Res (@NextEraEnergyR) August 14, 2019

https://www.facebook.com/jessa.paddock/posts/1227067647466110