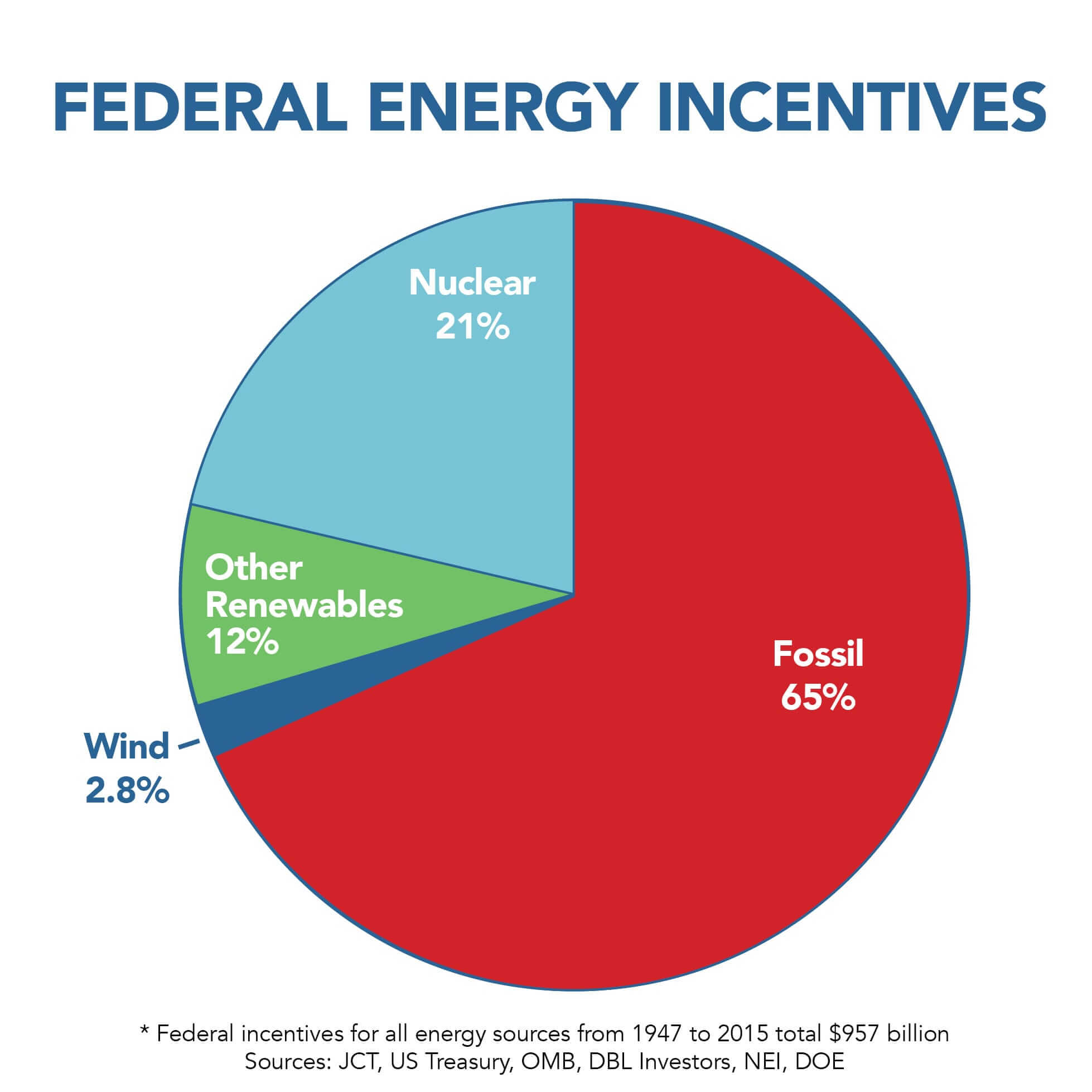

New analysis: Wind energy less than 3 percent of all federal energy incentives

Wind energy still accounts for an extremely small share of all federal energy incentives, according to the most comprehensive review of energy incentives to date. AWEA’s compilation of all available data from government and other sources shows that for every dollar spent on federal energy incentives, wind energy received less than 3 cents.

Wind’s small share of all energy incentives may surprise some. Many incentives for conventional energy sources are written into the permanent tax code, making them far less visible than short-term incentives for renewable energy that must be brought up for extension, and debate, nearly every year. As Senator Charles Grassley (R-IA) has explained, “Opponents of the renewable energy provisions want to have this debate in a vacuum. They disregard the many incentives and subsidies that exist for other sources of energy, and are permanent law.”

However, the data from a range of third-party sources clearly show that wind and other renewables are a small share of total incentives. AWEA compiled data from a range of government sources linked below, as well as groups like the Nuclear Energy Institute and investment firm DBL Partners, to arrive at this comprehensive tally of federal energy incentives. This includes all federal spending for research and development, tax incentives, direct deployment incentives, and other policy interventions.

| Energy resource | Cumulative incentives (billions) | Source |

| Total fossil | $619 | NEI, CRS, JCT, DOE |

| Nuclear | *$197 | DBL, CRS, JCT, DOE; *(1947-2015, vs 1950-2015 for other energy sources) |

| Wind | $27 | JCT, CRS, Treasury, DOE |

| Other Renewables (including biofuels) | $114 | NEI, JCT, CRS, Treasury, DOE |

| Total | $957 |

Having incentives for other energy sources in the permanent tax code not only makes them less visible than policies like the renewable production tax credit (PTC) that must be frequently renewed, but also makes them more valuable by providing long-term predictability to the businesses that use them.

Because fossil and nuclear energy sources today continue to benefit from policy support received in the past, cumulative incentives provide the most accurate view of the incentive playing field. Past incentives reduced the cost of energy from these sources and allowed them to expand, further reducing the cost of fossil and nuclear energy to what it is today. Some fossil fuel incentives have been in the permanent tax code for nearly 100 years, four times longer than the renewable PTC has been intermittently available, and 10 times longer than the period over which PTC has seen significant use.

The PTC is an American success story

The performance-based PTC has enabled the wind industry to make investments in America’s manufacturing and workforce, cutting the cost of wind by more than 60 percent over the last six years. Unlike policies in some other countries that incentivize deployment, the PTC incentivizes developers to build and deploy the most productive turbines by directly incentivizing the production of zero-emission, zero-fuel-cost, domestic wind energy. Partly as a result, U.S. wind turbines are nearly twice as productive as those in China and Germany. The U.S. leads the world in wind energy production, even though China has installed nearly twice as much wind generating capacity.

The PTC also corrects for externality costs that are not accounted for in the market, resulting in a more efficient market outcome. Wind energy creates billions of dollars in economic value by drastically reducing pollution that harms public health and the environment, but wind does not get paid for providing this benefit. Wind energy also protects consumers from fuel price increases, but that benefit is not accounted for in the highly regulated electricity market because other energy sources get to pass their fuel price increases directly on to consumers, who have little choice in the matter.

Recent analysis confirms that each Megawatt-hour (MWh) of wind energy, the amount produced by a typical turbine in a little over an hour, provides $75 in benefits for human health and the environment by reducing air pollution. This benefit alone is more than three times the cost of the $23/MWh PTC. That study also found that wind provides an additional benefit to consumers by reducing the price of electricity and fossil fuels, resulting in consumer savings of between $13 and $49/MWh. The analysis did not even attempt to quantify wind’s additional economic value from reducing water consumption and protecting consumers from fossil fuel price volatility and uncertainty. The net benefits of the PTC are actually several times larger than this, as a wind project only receives the PTC for the first ten years of operation, but the project will continue to provide clean energy for many decades.

Nearly the entire value of the wind PTC is passed through directly to American consumers in the form of lower prices for the long-term power purchase agreements utilities sign with wind projects. While the PTC does not significantly affect prices in the spot electricity markets where competing generators sell their electricity, the PTC does decrease prices for long-term power purchase agreements, directly benefiting American consumers. In contrast, many other energy incentives have a small impact on consumer prices in the U.S. because those commodities are traded on a global basis, so a large share of the incentive value flows to consumers in other countries.

It should also be noted that wind and solar energy are the only energy sources to have their primary federal incentive phased down, while fossil and nuclear energy continue to receive incentives that in many cases are written into the permanent tax code. Based on government projections through the year 2025, around the time currently incentivized wind projects will no longer receive the PTC, wind energy will still only account for around 6 percent of total federal energy incentives.

Despite myths to the contrary, the data show that the overall impact of federal energy incentives has been to create a playing field that is slanted against renewable energy. Even with these headwinds, the wind energy industry is succeeding in reducing costs and scaling up American manufacturing thanks to the performance-based Production Tax Credit.